Management Accounting

Last Update Apr 4, 2025

Total Questions : 180

Why Choose CramTick

Last Update Apr 4, 2025

Total Questions : 180

Last Update Apr 4, 2025

Total Questions : 180

Customers Passed

CIMA P1

Average Score In Real

Exam At Testing Centre

Questions came word by

word from this dump

Try a free demo of our CIMA P1 PDF and practice exam software before the purchase to get a closer look at practice questions and answers.

We provide up to 3 months of free after-purchase updates so that you get CIMA P1 practice questions of today and not yesterday.

We have a long list of satisfied customers from multiple countries. Our CIMA P1 practice questions will certainly assist you to get passing marks on the first attempt.

CramTick offers CIMA P1 PDF questions, and web-based and desktop practice tests that are consistently updated.

CramTick has a support team to answer your queries 24/7. Contact us if you face login issues, payment, and download issues. We will entertain you as soon as possible.

Thousands of customers passed the CIMA Management Accounting exam by using our product. We ensure that upon using our exam products, you are satisfied.

A company’s management is considering investing in a project with an expected life of 4 years. It has a positive net present value of $180,000 when cash flows are discounted at 8% per annum. The project’s cash flows include a cash outflow of $100,000 for each of the four years. No tax is payable on projects of this type.

The percentage increase in the annual cash outflow that would cause the company’s management to reject the project from a financial perspective is, to the nearest 0.1%:

A company uses a standard costing system.

The company’s sales budget for the latest period includes 1,500 units of a product with a selling price of $400 per unit.

The product has a budgeted contribution to sales ratio of 30%.

Actual sales for the period were 1,630 units at a selling price of $390 per unit.

The actual contribution to sales ratio was 28%.

The sales volume contribution variance for the product for the latest period is:

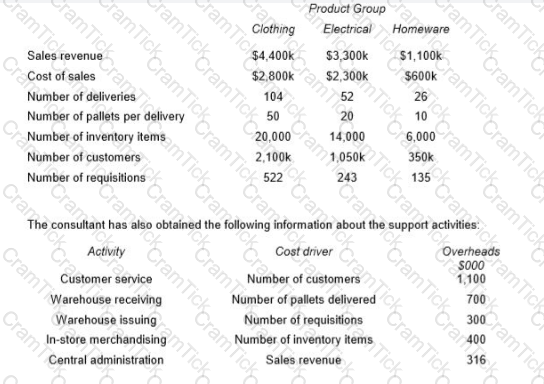

A major company sells a range of electrical, clothing and homeware products through a chain of department stores. The main administration functions are provided from the company’s head office. Each department store has its own warehouse which receives goods that are delivered from a central distribution center.

The company currently measures profitability by product group for each store using an absorption costing system. All overhead costs are charged to product groups based on sales revenue. Overhead costs account for approximately one-third of total costs and the directors are concerned about the arbitrary nature of the current method used to charge these costs to product groups.

A consultant has been appointed to analyses the activities that are undertaken in the department stores and to establish an activity based costing system.

The consultant has identified the following data for the latest period for each of the product groups for the X Town store:

Calculate the total profit for each of the product groups:

…. using the current absorption costing system;