Financial Reporting

Last Update Apr 3, 2025

Total Questions : 248 With Methodical Explanation

Why Choose CramTick

Last Update Apr 3, 2025

Total Questions : 248

Last Update Apr 3, 2025

Total Questions : 248

Customers Passed

CIMA F1

Average Score In Real

Exam At Testing Centre

Questions came word by

word from this dump

Try a free demo of our CIMA F1 PDF and practice exam software before the purchase to get a closer look at practice questions and answers.

We provide up to 3 months of free after-purchase updates so that you get CIMA F1 practice questions of today and not yesterday.

We have a long list of satisfied customers from multiple countries. Our CIMA F1 practice questions will certainly assist you to get passing marks on the first attempt.

CramTick offers CIMA F1 PDF questions, and web-based and desktop practice tests that are consistently updated.

CramTick has a support team to answer your queries 24/7. Contact us if you face login issues, payment, and download issues. We will entertain you as soon as possible.

Thousands of customers passed the CIMA Financial Reporting exam by using our product. We ensure that upon using our exam products, you are satisfied.

OP is considering investing in government bonds. The current price of a $100 bond with 8 years to maturity is $88.

The bonds have a coupon rate of 6% and repay face value of $100 at the end of the 8 years.

Calculate the yield to maturity.

Give your answer to one decimal place.

Country A permits the following deductions in an entity's annual corporate income tax return in relation to entertaining expenses and gifts;

1 Employee entertaining up to a value of $150 a head

2 Entertaining of overseas customers.

3 Individual gifts not to exceed $10 in value

Which THREE of the following actions would be regarded as tax evasion?

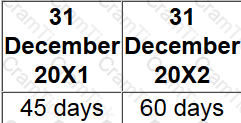

AB has been asked to analyze the receivables days of an entity with a view to improving the working capital cycle.

The following results have been produced for receivable days:

Which of the following is NOT an explanation of why the days have increased?