MN recently took out a 5 year term loan to buy raw materials to take advantage of a supplier's bulk discount that had been offered to them.

What approach to financing working capital has MN undertaken?

Which of the following would NOT be considered an element of a regulatory framework for financial reporting?

Which THREE of the following are costs that a business might incur as a result of holding insufficient inventory of raw materials?

An entity bought a capital item for $110,000 on 1 March 20X4 incurring legal fees at the date of purchase of $2,500.

On 1 May 20X4 additional costs classified as capital expenditure by the tax rules of the country of $25,000 were incurred in respect of the asset. On 1 June 20X4 repairs not classified as capital expenditure were incurred at a cost of $15,000.

The asset was sold for $250,000 on 30 November 20X8 and costs to sell were incurred of $4,300.

Calculate the chargeable gain on the disposal.

Give your answer to the nearest $.

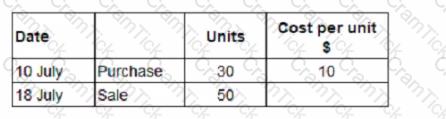

On 1 July 20X8 JKL has 100 units of inventory, which cost $8 each. The following transactions arose during the month of July:

JKL values inventory using the first in. first out method.

What is the value of JKL's inventory at 31 July 20X8?

Give your answer to the nearest $.

An entity has a number of subsidiary and associate investments.

Which of the following must be disclosed in the entity's separate financial statements if it is exempt from presenting consolidated financial statements?

Entity RH has an recognised a taxable profit of $1.Smillion for 20X1'. In Entity RH's resident country. Country M, depreciation charges and entertaining expenses are disallowed expenses. Below is some information on

Entitry RH's outgoings for the period:

Depreciation charged on PPE: $450,000

Political donations: $155,000

Staff parties: $3,200

Cost of updating assets: $10,000

Other expenses: $83,500

In Country M, there is a standard corporation tax of 12% charged on all corporation profits. What is Entity RH's total tax liability for this period?

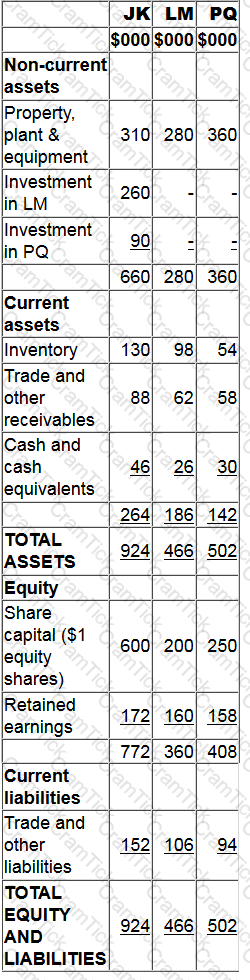

Statements of financial position as at 31 December 20X8 for JK, LM and PQ are as follows:

[1] JK purchased 80% of LM's $1 equity shares on 1 January 20X8 for $260,000 when the retained earnings of JK were $110,000. At that date the non-controlling interest had a fair value of $63,000.

[2] JK purchased 25% of PQ's $1 equity shares on 1 January 20X8 for $90,000 when the retained earnings of PQ were $96,000.

[3] During the year JK sold goods to LM for $32,000 at a mark up of 33.33% on cost. Half of the goods were still in LM's inventory at 31 December 20X8.

[4] LM transferred $32,000 to JK on 30 December 20X8 in settlement of the inter-group trade. JK did not record the cash in its financial records until 2 January 20X9.

Calculate the value of inventory that would be included in JK's consolidated statement of financial position at 31 December 20X8.

Give your answer to the nearest $.

Which THREE of the following are part of the International Accounting Standards Committee (IASC) Foundation structure?

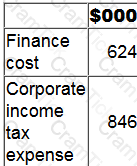

The following information is extracted from QQ's statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March 20X1.

The following information if included within QQ's statement of profit or loss for the year ended 31 March 20X2.

Included within finance cost is $124,000 which relates to interest paid on a finance lease. QQ includes finance lease interest within financing activities on its statement of cash flows.

What cash outflow figure should be included as interest paid within the net cash flow from operating activities for QQ for the year ended 20X2?

Give your answer to the nearest $000.

RS purchased an asset on 1 May 20X1 for $200,000, exclusive of import duties of $25,000.

The asset was sold on 1 December 20X3 for $450,000, incurring costs to sell of $15,000.

RS is resident in Country Y where indexation is allowable from the date of purchase to the date of sale.

The indexation factor increased by 40% in the period 1 May 20X1 to 1 December 20X3.

Capital gains are taxed at 25%.

What is the capital tax due from RS on disposal of the asset?

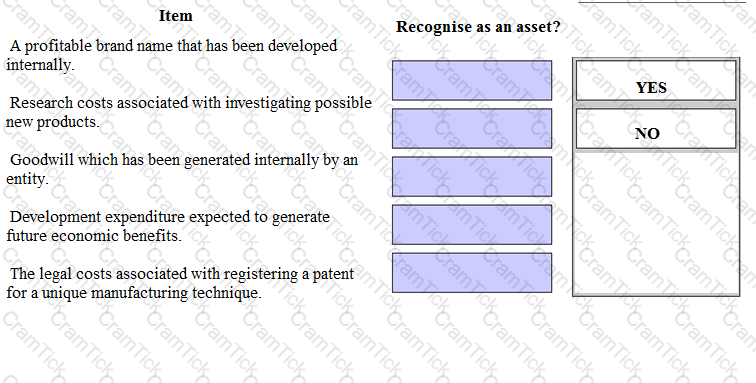

Identify from the list below which items can be recognised as assets within the financial statements of an entity in accordance with IAS 38 Intangible Assets. Place either yes or no as appropriate against each item.

In most developed countries employers deduct the tax from employees' pay each month and then pay the tax to the tax authorities on behalf of the employee on a monthly basis.

Which THREE of the following are advantages of this system to the employee?

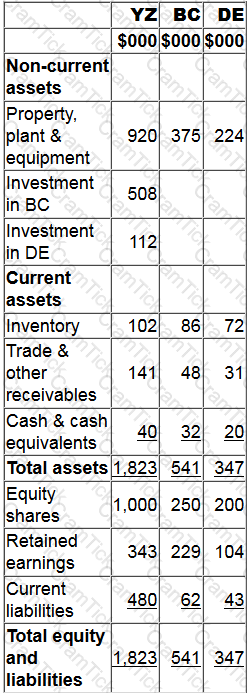

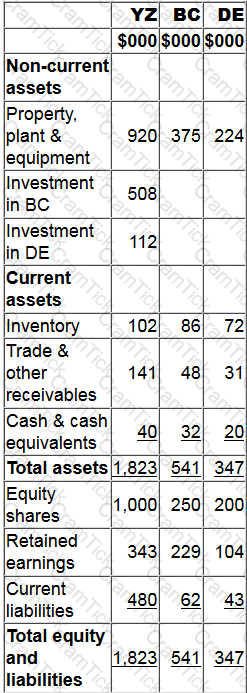

Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April 20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the value of inventory that will be included in YZ's consolidated statement of financial position at 31 March 20X2.

Give your answer to the nearest whole $.

The development of an international financial reporting standard generally goes through a number of stages.

Which of the following is NOT a stage of development?

Which one of the following is NOT a step in the development of an International Financial Reporting Standard (IFRS)?

CDO is an entity that is preparing to apply to its local stock market for a listing. CDO is currently run by a board of ten directors, each of whom manages a department of CDO. The board is chaired by Ms E who is also CDO's Chief Executive Officer.

Which TWO of the following actions would assist CDO to meet corporate governance regulations?

Company RET's financing activities are exactly 35% of their operating activities expenses each month. Below is a list of Company RET's total expenses for this month:

Inventory supplies purchased: £145,000

Employee wages: £65,000

Purchase of a shop: £105,000

Dividend payments: ??

Cash repayments on loan: £61,000

What is company RET's total dividends payment for this month?

Country X levies corporate income tax at a rate of 25% and charges income tax on all profits irrespective of whether they are distributed by way of dividend. Country Y levies corporate income tax at a rate of 20%.

A, who is resident in Country X, pays a divided to B, who is resident in Country Y. B is required to pay corporate income tax on the dividend received from A, but a deduction can be made for the tax suffered on this dividend restricted to a rate of 20%.

Which method of relief for foreign tax does this describe?

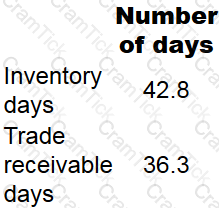

AAA has the following working capital ratios at 30 March 20X4:

During the year ended 30 March 20X4 credit purchases were $3,600 and at 30 March 20X4 the outstanding trade payables amounted to $522.

The year ended 30 March 20X4 was not a leap year.

Calculate the working capital cycle for AAA.

Give your answer to one decimal place.

Which of the following is NOT a primary need for regulating financial reporting information of incorporated entities?

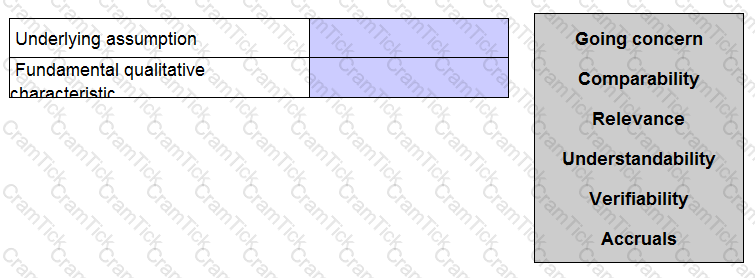

The Conceptual Framework for Financial Reporting issued by the International Accounting Standards Board (known as the IASB's conceptual framework) includes one underlying assumption about the preparation of financial statements and two fundamental qualitative characteristics for financial information.

Identify the underlying assumption and one of the fundamental characteristics by placing one of the options in each of the boxes below.

Country X charges corporate income tax at the rate of 20% on all income irrespective of whether it is paid out as a dividend. Country Y charges corporate income tax at the rate of 25% on all income.

An entity, AA, which is resident in Country X pays a dividend of $100,000 to another entity, BB, which is resident in Country Y.

Countries X and Y have a double taxation treaty which adopts the exemption method in respect of this type of transaction.

What is BB's liability to tax in Country Y in respect of the dividend income received?

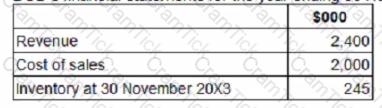

BCD's financial statements for the year ending 30 November 20X3 include the following:

Inventory at 30 November 20X2 was $220,000.

What is BCD's average inventory holding period for the year ended 30 November 20X3?

On 31 July 20X8, CDE's directors decided to sell an asset with a carrying amount of $26,000. On that date it ceased to be used in readiness for its sale.

There is an active second-hand market for this type of asset and it has been advertised at its market value of $24,000 When a seller is found, the asset will need to be dismantled at a cost of $1,000

What is the amount to be recognised as an asset held for sale on 31 July 20X8?

Give your answer to the nearest $.

UK purchased an asset, with a useful economic life of 10 years, on 1 January 20X5 for $40,000. The asset was revalued on 31 December 20X6 to 544,000 and the directors believed its total useful economic life remained unchanged On 31 December 20X7 UK sells the asset for $50,000

How much will be recorded as a profit on disposal of the asset in UK's statement of profit or loss for the year ended 31 December 20X7?

Give your answer to the nearest $.

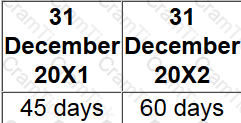

AB has been asked to analyze the receivables days of an entity with a view to improving the working capital cycle.

The following results have been produced for receivable days:

Which of the following is NOT an explanation of why the days have increased?

HI commenced business on 1 April 20X3. Sales in April 20X3 were $30,000. This is forecast to increase by 2% per month.

Credit sales accounted for 50% of sales. Credit sales customers are allowed one month to pay; 75% of April credit customers paid on time. A further 20% are expected to pay after more than one month, but before two months. The remaining 5% are not expected to pay. All these percentages are expected to continue in the near future.

Calculate the total amount of cash HI should forecast to be received in June 20X3.

Give your answer to the nearest whole $.

OP is considering investing in government bonds. The current price of a $100 bond with 8 years to maturity is $88.

The bonds have a coupon rate of 6% and repay face value of $100 at the end of the 8 years.

Calculate the yield to maturity.

Give your answer to one decimal place.

Country A permits the following deductions in an entity's annual corporate income tax return in relation to entertaining expenses and gifts;

1 Employee entertaining up to a value of $150 a head

2 Entertaining of overseas customers.

3 Individual gifts not to exceed $10 in value

Which THREE of the following actions would be regarded as tax evasion?

On 31 March 20X1 OP decided to sell a property. On that date this property was correctly classified as held for sale in accordance with IFRS 5 Non-Current Assets Held For Sale And Discontinued Operations.

In the draft financial statements of OP for the year ended 31 October 20X1 this property has been included at its fair value, which was $520,000 lower than its carrying value. This has resulted in a charge to profit or loss, the result of which is that the draft financial statements show a loss of $450,000 for the year to 31 October 20X1. When the management board of OP reviewed the draft financial statements it was unhappy about the loss and decided that the property should be reclassified as a non-current asset and reinstated to its original value, despite the fact that its plans for the property had not changed.

In accordance with the ethical principle of professional competence and due care, which THREE of the following statements explain how this property should be accounted for in the financial statements of OP for the year ended 31 October 20X1?

The International Accounting Standards Board's "The Conceptual Framework for Financial Reporting" identifies fundamental and enhancing qualitative characteristics of financial statements.

Which of the following is included within the fundamental characteristics?

XY is an entity incorporated in Country B but operates in several countries. Monthly management meetings to decide on strategic matters take place in Country A, where the majority of its production happens. XY sells most of its goods to Country C.

In accordance with the Organization for Economic Co-operation and Development (OECD) rules on corporate residence which of the following statements is true?

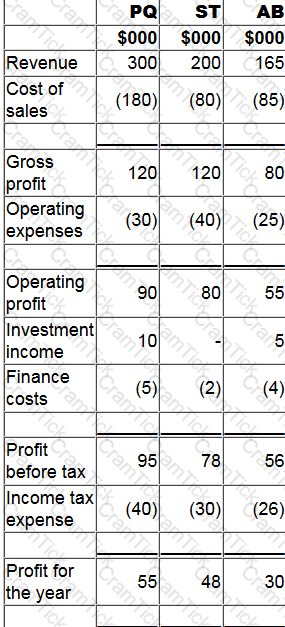

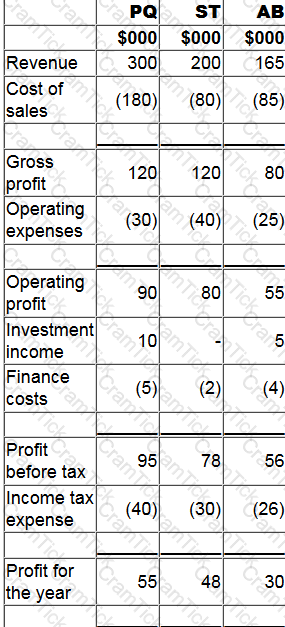

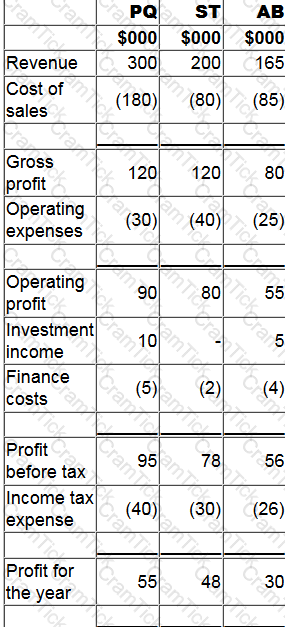

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

Calculate the profit attributable to the non-controlling interests disclosed in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0.

Give your answer to the nearest whole $.

LM is preparing its cash forecast for the next three months.

Which of the following items should be left out of its calculations?

In accordance with IAS 16 Property, Plant and Equipment, in which of the following situations would subsequent expenditure on a non-current asset be capitalised?

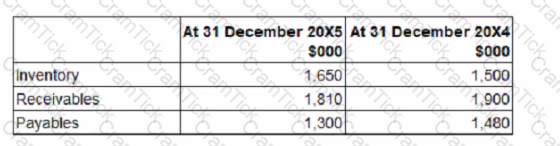

The following information has been extracted from GHI's statement of financial position:

Which of the following is the total cash flow for working capital changes to be recorded in GHI's statement of cash flows for the year ended 31 December 20X5?

Which THREE of the following statements are NOT true of the IFRS Foundation trustees?

Which of the following methods could be used by a tax authority to reduce tax evasion and avoidance?

In an entity's statement of profit or loss and other comprehensive income, which of the following would be presented as other comprehensive income?

When developing local Generally Accepted Accounting Principles (known as local GAAP) some countries start with International Financial Reporting Standards (IFRSs) which are then amended to reflect local needs and conditions.

This type of approach is classified as:

The following information relates to a single asset:

*Original cost of $186,000

*Estimated residual value of $6,000

*Expected useful life of 10 years

*Accumulated depreciation at 31 December 20X5 of $66,960

*Annual depreciation rate of 20% on a reducing balance basis

Calculate the amount of depreciation that should be charged to profit or loss for the year ended 31 December 20X6.

Give your answer to the nearest whole number.

XY acquired 75% of the equity shares of CD on 1 January 20X2 for $230,000.

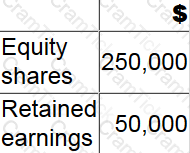

On 1 January 20X2 CD had the following balances:

XY uses the proportionate share of net assets method to value non controlling interest at acquisition.

Calculate the goodwill arising on the acquisition of CD.

Give your answer to nearest whole number.

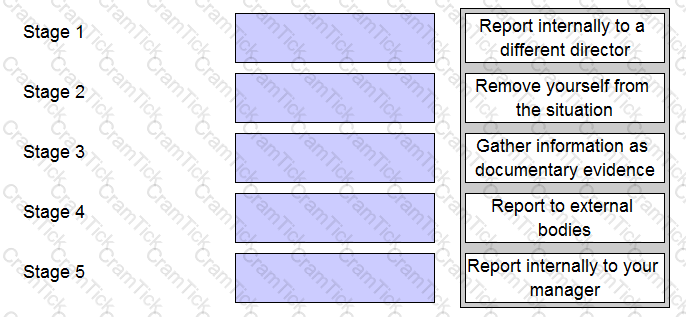

You work in the finance department of an entity. A director has approached you and asked you to falsify sales invoices which would significantly inflate revenue. The CIMA Code of Ethics suggests that you should deal with such an ethical dilemma by following a number of stages.

Place each of the stages identified below into chronological order.

An entity's policy is to finance the investment in working capital using short-term financing to fund all of its investment in fluctuating net current assets as well as some of its investment in permanent net current assets.

What is this working capital financing policy known as?

A building was purchased on 1 January 20X1 for $300,000 and had a useful economic life of 40 years. On 1 January 20X5 the building was revalued by a professional surveyor at $450,000. Directors decided to incorporate the revalued amount into the financial statements.

The accounting entries to record the initial revaluation of the building in the financial statements for the year ended 31 December 20X5 will be to debit building cost $150,000 and then:

To apply the fundamental principles of the Code of Ethics, existing and potential threats to the entity first need to be identified and evaluated.

Which THREE of the following are identified in the Code as threats?

Country X levies a duty on alcoholic drinks. Where the alcohol content is above 40% by volume the duty levied is $5 per 1 litre bottle.

What type of tax is this duty?

Company Y is using some of the money from a share issue to purchase a new office building. The company is also using some of the money to purchase inventories. Which method of financing is this?

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

What is the revenue figure to be included in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0?

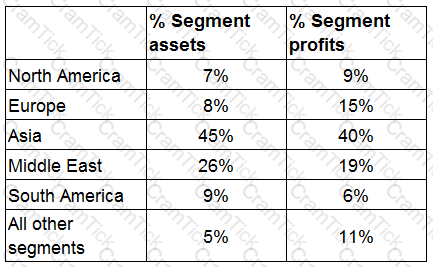

OP has five main geographic segments and reports segmental information in accordance with IFRS 8 Operating Segments.

Which THREE of the following would be regarded as operating segments of OP in accordance with IFRS 8?

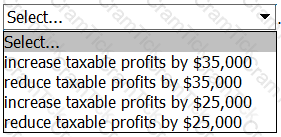

For the year ending 31 March 20X2, MN made an accounting profit of $120,000. Profit included $8,500 of political donations which are disallowable for tax purposes and $8,000 of income exempt from taxation.

MN has $15,000 of plant and machinery which was acquired on 1 April 20X0 and purchased a new machine costing $25,000 on 1 April 20X1. This new machine is entitled to first year allowances of 100% instead of the usual tax depreciation of 20% reducing balance. All plant and machinery is depreciated in the accounts at 10% on cost.

MN also has a building that cost $120,000 on 1 April 20X0 and is depreciated in the accounts at 4% on a straight line basis. Tax depreciation is calculated at 3% on a straight line basis.

Calculate the taxable profit.

Give your answer to the nearest $.

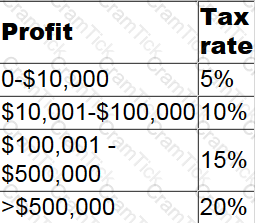

In Country X corporate income tax is levied on profits as follows:

Which of the following describes the tax rate structure in Country X?

QR purchased a property for its investment potential on 1 January 20X3 for $2.5 million.

The total property cost is split as follows: land $1 million and buildings $1.5 million. The buildings were expected to have a remaining useful life of 40 years.

The local property index at 31 December 20X3 indicates that the fair value of the property has risen by 10%.

What is the balance that QR will include in its statement of financial position at 31 December 20X3 for this property, assuming that it uses the IAS 40 Investment Properties fair value model?

Give your answer in $million to two decimal places.

Which of the following is the responsibility of the International Financial Reporting Standards Interpretations Committee?

Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April 20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the amount of the non-controlling interest to be included in YZ's consolidated statement of financial position at 31 March 20X2.

Give your answer to the nearest whole $.

Which of the following correctly identifies the order of the steps involved in the development of an International Financial Reporting Standard prior to it being issued?

Company R use a defined benefit plan pension scheme. Employee UW has been working for Company R for 25 years. The defined benefit plan is 1.5% of the employee's annual salary during their time at the company,

for every year of employment.

Employee UW started on a £18,000 per annum salary. After 10 years of employment. Employee UW received a promotion and began earning £22,000. After another 3 years of employment. Employee UW got promoted

to a wage of £35,000, and is still on this salary now. How much pension has Employee UW accumulated since working at Company R?

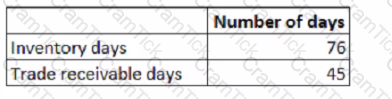

ABC has the following working capital ratios at 31 December 20X2:

During the year ended 31 December 20X4 credit purchases were $1,700,000 and at 31 December 20X4 the outstanding trade payables balance was $340,000

During the year ended 31 December 20X4 credit purchases were $1,700,000 and at 31 December 20X4 the outstanding trade payables balance was $340,000

Calculate the working capital cycle for ABC.

Give your answer to the nearest whole number of days and assume there are 365 days in a year.

Which THREE of the following are conditions that must be met to allow an asset to be categorised as held for sale?

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

Calculate the amount that will be shown as the share of profit of associate in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0.

AB sells to ST, a group entity, 10,000 units at $2.50 each. The market value was $6 each.

The effect on AB of the transfer pricing legislation on this transaction would be to: .