When providing wage data for a workers’ compensation audit, which of the following wage types would be included as compensation?

The process used to verify and validate payroll system edits or warnings is called:

Which of the following criteria is NOT used to determine if the worker is a nonresident for U.S. income tax purposes?

The lowest priority is given to which of the following time management categories?

The purpose of the prenotification process for direct deposit is to ensure that the transaction is:

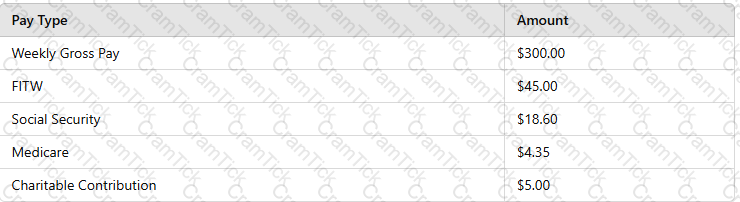

Under theCCPA, use the following information to calculate theMAXIMUMdeduction for the child support order for an employee whois not supporting another family and not in arrears.

When a payer receives a “B” Notice, it must send a copy of the notification to the payee within:

Which of the following forms of identification CANNOT be used in Section 2 of Form I-9?

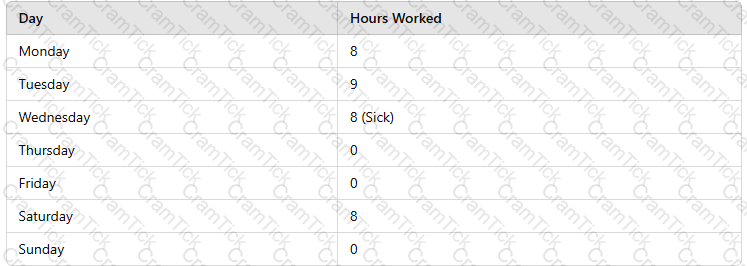

Using the following schedule for an employee who earns $9.00 per hour, calculate the overtime premium required under the FLSA.

A state's minimum wage is $0.60 higher than the federal minimum wage. Under the FLSA, for an employee age 20, what is the MINIMUM hourly rate an employer can pay the employee?

A semiweekly depositor accumulates a payroll tax liability of $49,000.00 on Thursday. The next day, the company has bonus payroll with a tax liability of $120,200.00. Calculate the amount of tax deposit and its due date.

Using the following information, calculate the employer's total FICA tax liability for the first payroll of the year.

Which of the following simulations would NOT be performed when testing a disaster recovery plan?

As of December 31, 2024, what is the MAXIMUM amount, if any, a 49-year-old employee can contribute to a 401(k) plan?

To reconcile a general ledger tax liability account balance, verify all of the following items EXCEPT:

Using the following information from a payroll journal, calculate the total Social Security tax liability for the first payroll of the year:

An employee has received $169,000.00 in YTD earnings. The employee receives a payment of $16,600.00. The employer Medicare tax, if any, is:

Specifying a defined response time for an employee's payroll-related question is a component of a Payroll Department’s:

Which of the following statements about payments made under workers' compensation benefits is FALSE?

An employee clocked in for work at 8:07 a.m. and out at 4:08 p.m. According to the DOL policy on rounding work hours, which of the following recorded hours are CORRECT?

When an employee fails to cash a payroll check and the employer cannot locate the employee, the Payroll Department should:

Even if a worker meets the definition of an employee, an employer can still treat the worker as an independent contractor if the worker passes the:

A mechanism which facilitates local tax withholding for an employee who is working abroad, but remains on the home country’s payroll system and is paid under a tax equalization plan, is called a(n):

Which of the following statements is TRUE regarding the pre-notification process?

An upgrade to a payroll system can impact all of the following documentation within the payroll department EXCEPT:

Which form is used by third-party administrators to report sick pay paid on behalf of an employer?

All of the following statements are correct regarding independent contractors EXCEPT that they:

Which of the following documents listed on Form I-9 can be used to establish both an employee's identity and employment eligibility?