Which of the following statements is true when comparing fund of funds to traditional mutual funds?

Sandra presently participates in her employer-sponsored defined contribution pension plan (DCPP). As contributions continue to be made into her plan, what can she expect?

Stan, a portfolio manager, is looking at two steel companies as potential investments. Truesteel Inc. has a current ratio of 2:1 while Strongco Ltd. has a current ratio of 0.8:1.

What could this information indicate?

Derek submits an order to sell 300 units of the Evergreen Canadian Mortgage Fund at 8:00 p.m. EST on Friday, January 6. His proceeds will be based on the net asset value per unit (NAVPU) for which day (assume no holidays)?

During the calendar year, Firmansyah received a $1,800 eligible dividend from a large Canadian bank and a $US dollar (USD) dividend of $882.02 from a foreign-based corporation. The USD/CAD exchange rates is 1.3605.

Firmansyah's federal marginal tax bracket is 29%. The enhanced dividend gross-up rate is 38% and the federal dividend tax credit rate for eligible dividends is 15%.

What federal tax liability will be result from his investment income?

Greg, one of your clients, has been advised by a friend to invest in open-end mutual funds. He is not sure about the differences between open and closed-end funds.

What would you tell Greg about open-end funds?

Quintin has been a Dealing Representative for Global Maximum Financial for 5 years. Today, he opened an account for his new client, Reginald. In addition to opening a new account, Reginald agreed to

accept Quintin's investment recommendation and placed a purchase order to buy units of the Global Maximum Value Equity fund.

Quintin informed his Branch Manager Lupita about this new account on the same day the purchase order was received. Lupita told Quintin that she would complete her review of the New Client Application

Form (NCAF) by no later than tomorrow.

Which statement regarding this new account opening is CORRECT?

Darryl has a diversified investment portfolio of mutual funds in a non-registered account with Investwell Mutual Funds, a mutual fund dealer. Darryl’s diversified portfolio is composed of 3 mutual funds. Each mutual fund is currently worth about $100,000. The ABC Canadian Equity Fund has a total return of 6%, the DEF Bond Fund has a total return of 8% and GHI Global Equity Fund has a total return of 10%. Darryl wants to make an in-kind contribution to his registered retirement savings plan (RRSP) account. He has unused RRSP contribution room of $60,000.

From a tax-efficient viewpoint, which funds contribute in-kind to his RRSP account?

In a mutual fund dealer, who is the person responsible for establishing and maintaining compliance policies and procedures as well as monitoring and assessing compliance?

Janine will celebrate her 71st birthday this year. She currently has a lot of money in a personal registered retirement savings plan (RRSP) and knows there are rules about what she can do with those funds. Which of the following is TRUE?

Patrick is a portfolio manager for the HyperTally Growth Fund. It has generated an annualized rate of return of 10% this past year. However, with the anticipation of very high inflation to soon occur, there is also an expectation of higher interest rates. Patrick is concerned about the future returns of existing stocks within the fund. What may Patrick do to protect against the market value of the fund dropping?

Which of the following qualifies as personal information under the Personal Information Protection and Electronic Documents Act (PIPEDA)?

Sarah and Kyle are a married couple. They are both 34 years of age and work as teachers. Their combined annual income is $130,000. They are able to save $800 each month. They own a home worth

$340,000 with a $120,000 mortgage. Since they work for the same employer, they have the same defined benefit pension plan. Other than a tax-free savings account (TFSA) in Kyle's name with $5,000, they do not have any other assets.

They are avid sailors and want to save towards a purchase of a sailboat. For the type of sailboat they want, they estimate it should cost around $65,000. They want you to recommend an investment for their monthly savings to help them achieve their goal faster.

What question should you ask them next?

Solomon is a Dealing Representative who is excited about a new equity fund his dealer recently approved. He thinks investors will be attracted to the fund’s historical performance. He has a prospective new client, Madira, who is 25 years old. Madira has invested in mutual funds before, but not with Solomon’s dealer. She has made an appointment to open a new RRSP with Solomon’s firm.

What does Solomon need to do to make this a suitable recommendation?

Maureen is 65 years old and will be retiring soon. She has a modest portfolio of mutual funds that focus on growth. As she approaches retirement, Maureen wants to switch to investments that provide steady income with low to medium risk.

Given Maureen’s wishes, which of the following mutual funds would be suitable for her?

Barend is a Dealing Representative with Planvest Group Inc., a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA). Which of the following CORRECTLY describes

Barend's obligation for conflicts of interest?

What purpose does it serve for non-money market mutual funds to hold money market instruments?

Which of the following statements about registered education savings plans (RESPs) is CORRECT?

Sean purchases 500 units of Penn Canadian Equity Fund when the net asset value per unit (NAVPU) is $16.70. On December 15, the mutual fund’s NAVPU is $21. On December 16, the mutual fund declares a distribution of $1.25 per unit. Sean’s distribution is immediately reinvested and he purchases additional units of the mutual fund.

Which of the following statements about the effect of the distribution is correct?

Exchange traded funds (ETFs) that track an index and index mutual funds have many similarities. However, what is a major difference between these two products?

Faruq is a Dealing Representative with Smart Planning Group, a mutual fund dealer. Faruq meets with his new client, Taline, and learns that she lives on a low, fixed income.

Taline tells Faruq that she wants to maximize her investment returns as high as possible to make up the difference. Taline also indicates that she cannot afford large investment losses because her income is low. Which of the following CORRECTLY describes how Faruq should assess Taline’s risk profile?

While assessing the suitability of an investment recommendation as a Dealing Representative, which statement applies to the "Client's Interest First" standard?

Pippa purchased a 15-year bond with a face value of $5,000 and a 7% coupon rate at the time of issuance. The bond is due to mature later this year. The general interest rate climate remained stable for the first 13 years of the bond's term. However, especially over the past 18 months, both inflation and general interest rates have increased more than expected.

What is Pippa likely to experience from her bond?

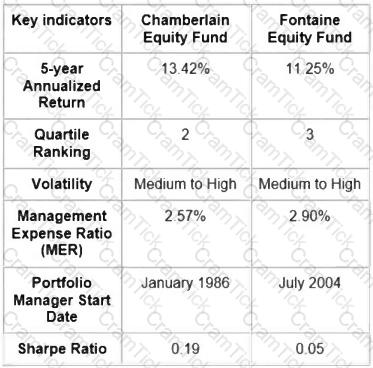

You have been researching Canadian equity mutual funds for a new client. You come across the following information.

What can you conclude from this information?

Gregory is a conservative investor who wants to hold a portfolio of equity securities that would fall less than the overall market in a downturn.

Which of the following portfolios would you advise Gregory to invest in?

The owners of Underground Airways Ltd. want to take their privately owned corporation public through an initial public offering (IPO). They are speaking to a specialist from an investment dealer to determine whether it would be advisable to become listed on a stock exchange or the over-the-counter (OTC) market.

In comparing the two options, which of the following considerations is TRUE?

As a measurement of risk, which of the following statements about beta is TRUE?

Danica is looking for a mutual fund to hold in her non-registered account that provides a regular stream of income with potential for capital growth. She is having difficulty distinguishing between bond funds and dividend funds. Which of the following statements is TRUE?

Which of the following Dealing Representatives has CORRECTLY fulfilled their suitability obligation?

Your client Gerard is 30 years old and plans to retire at age 65. He has a mutual fund portfolio of $40,000 in which he invests $1,500 monthly. Gerard's objective is to use these funds to meet the 20% down payment requirement to buy a house for $650,000.

What is Gerard's investment time horizon not considering market fluctuations?

Your employer has a contributory group RRSP under which he matches employee contributions, up to a maximum of 5% of salary.

Which of the following statements about a group registered retirement savings plan (RRSP) is CORRECT?

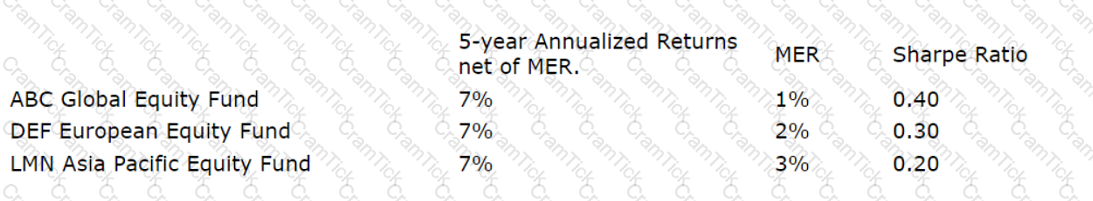

Danny is a Dealing Representative for Everbright Investments. He met with his client Adele, who has $1,000,000 to invest. During their meeting Danny determines that Adele has a high-risk profile. In addition, he learns that she has an excellent understanding of equities and how volatile they can be. Danny is considering recommending growth funds specifically, and making a recommendation from the following investment options:

Based on the information provided, which mutual fund should Danny recommend?

Sarah and Kyle are a married couple. They are both 34 years of age and work as teachers. Their combined annual income is $130,000. They are able to save $800 each month. They own a home worth $340,000 with a $120,000 mortgage. Since they work for the same employer, they have the same defined benefit pension plan. Other than a tax-free savings account (TFSA) in Kyle’s name with $5,000, they do not have any other assets.

They are avid sailors and want to save towards a purchase of a sailboat. For the type of sailboat they want, they estimate it should cost around $65,000. They want you to recommend an investment for their monthly savings to help them achieve their goal faster.

What question should you ask them next?

Louis is the portfolio manager for Quattro Fund. The mandate of the mutual fund is to invest in a combination of cash, fixed income, and equity securities; however, Louis has the ability to adjust the portfolio according to market conditions. If Louis feels that interest rates will fall, he could invest the whole portfolio in equities. If he feels the market is too high, he could take profits and sit totally in cash. What type of mutual fund is Quattro Fund?

Which of the following statements is TRUE about the movement of business cycles in the Canadian economy?

Jasmine received an inheritance from her grandmother of $10,000. She wants to invest her money wisely. She has seen in the news that a particular energy company is doing very well and has good prospects. She has also seen how volatile its share price has been in the last year. She knows the risks of the resource sector and wants to invest but is not comfortable with so much volatility. Which of the following mutual fund benefits would address her concern?

Which of the following statements about capital gains distributions from mutual fund trusts is correct?

Xerxes, 45 years old, is a successful architect, having an annual income of $185,000. He has around $10,000 in his non-registered account, which he is looking to invest in a tax-efficient manner.

From the following options, which would be the most tax-efficient?

Maxine is a portfolio manager who 15 years ago, purchased 100 shares of Never2Tacky, a social media corporation for Aspirations Global Technology Fund. She purchased the stock when it was trading at $10. Last year, the peak market price was $120. Presently, it is trading at $99. News agencies are now reporting that additional regulations regarding social media companies are about to be agreed upon by G7 countries. Maxine is concerned the market value of Never2Tacky is going to drop. She buys a put option with an exercise price of $95 with an expiry of 9 months.

What type of strategy is Maxine using?

Frederic recently sold his units in a US dollar (USD) denominated mutual fund. He wants to convert the proceeds back to Canadian dollars (CAD). If he received proceeds of $1,200 USD from the sale and the exchange rate is $1 CAD for $0.99 USD, how much will Frederic receive in Canadian dollars?

Catarina is a Dealing Representative for Ethical Financial which represents 20 different mutual fund families. Darlene is a fund manager from one of those mutual fund families and wants to send a gift card to Catarina as a symbol of appreciation. Ethical Financial's policies and procedures manual (PPM) require that Catarina decline the gift.

What method of addressing conflict of interest is being used by Ethical Financial?

Xian-Li believes she is a sophisticated investor. She has constructed her own portfolio and has had some success. She does not believe in studying a company’s details such as earnings, expenses, or assets. She is more concerned with patterns in a company’s stock price over time. She believes patterns form and can be used to predict future movements in the market.

How does Xian-Li evaluate the companies in her portfolio?