Refer to the Exhibit.

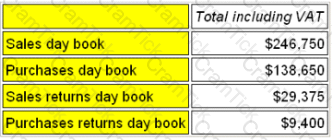

A company that is VAT-registered has the following transactions for the month of March.

All purchases were in respect of goods for resale and all items were subject to VAT at 17.5%.

Opening inventory was $16,200 and closing inventory was $18,400.

The movement on the VAT account for the period was:

Accounting records should be kept by all businesses for many reasons.

Which THREE of the following are reasons for keeping accounting records?

Entity V has a cost of sales of £23,850 for last year. Entity V's opening inventories for the year were £15,800, and its closing inventories were £3,570. Entity V had a gross profit margin of 240% for last year.

What was Entity V's inventories turnover figure to the nearest whole number for last year?

The record of how the profit or loss of a company has been allocated to distributions and reserves is found in the:

Refer to the Exhibit.

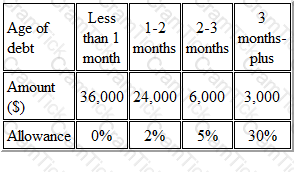

Berber Limited is preparing its year-end accounts and is reviewing the method used to estimate the allowance for receivables.

An aged receivables schedule shows the following position:

The company believes that the previous percentages used were not prudent enough and it has decided to increase the percentages on 2-3 months debt to 10% and on 3 months plus debt to 50%. The current allowance for receivables is $1,500.

What would be the effect on the income statement of the change in accounting policy

An entity decides to revalue its freehold property during the current period creating a revaluation surplus.

Where in the current period financial statements would the revaluation surplus appear?

Which THREE of the following would be recorded as a debit balance in the trial balance?

A company uses the straight line method of depreciation.

Which TWO of the following are a possible explanation for a profit on disposal?

Fraud will only be prevented successfully if potential fraudsters perceive the risk of detection as high.

Which THREE of the following are ways to prevent fraud?

If closing inventory at the end of an accounting period is overvalued by £2000 and no adjustment is made, the net profit in the following accounting period will be:

Which THREE of the below are possible reasons for an entity's capital amount to change?

Refer to the Exhibit.

Which of the following items should be included in the valuation of inventory in a manufacturing company?

Refer to the Exhibit.

A business writes a cheque using its overdraft balance to purchase new display shelving for its showroom

Which of the following is the dual effect?

If an auditor expresses an opinion of `fair presentation' on a set of financial statements, this means:

Where a transaction is entered into the correct ledger accounts, but the wrong amount is used, the error is known as an error of

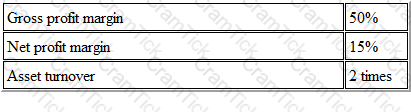

Refer to the exhibit.

The following ratios have been calculated for A Limited:

The return on capital employed for A Limited is therefore

Different users have different needs from financial information. One of which is to assess how effectively management is performing and how much profit will be available to be distributed.

Which of the following users will have this need for information?

Which one of the following is an example of where the accrual or matching convention should be applied?

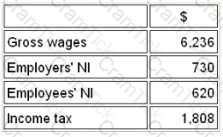

Refer to the Exhibit.

What is the wages expense for the income statement for month 1?

Which of the following methods of inventory valuation is not acceptable in the UK for financial reporting purposes?

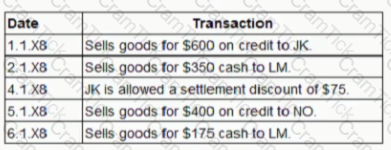

GH has the following transactions for the week of January 20X8:

GH is not registered for sales tax

What is the total of the sales day book for this week? Give your answer to the nearest whole number:

The purpose of charging the income statement with depreciation on non-current assets is:

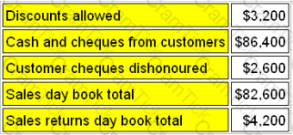

Refer to the Exhibit.

A company has the following information available for the month of June:

The opening receivables balance was $124,600.

The closing receivables balance at the end of June was

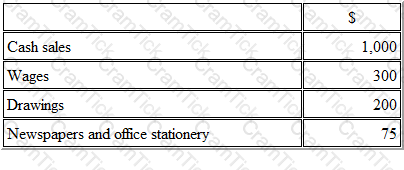

Refer to the Exhibit.

A sole trader, who only has cash sales, banks all cash receipts above the agreed petty cash float of $400.

During week 2 he has the following transactions:

What is the amount banked at the end of week 2?

Refer to the exhibit.

A company has the following equity balances at the beginning of the year:

During the year the company issued 100,000 new shares at $1.20 each

What are the equity balances after this issue?

Your organization owed VAT of $22,700 at the beginning of the month.

During the month, it sold standard-rated goods with a net value of $600,000. Its purchases and expenses during the same month amounted to $188,000 including VAT. It paid VAT to the Revenue and Customs, of $33,400. The VAT rate is 17.5%

At the end of the month, the balance on the VAT account was:

Which of the following transactions in the current year explains a reason for an increase in the gearing ratio of an entity from 35% last year to 45% this year?

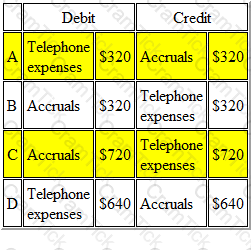

Refer to the Exhibit.

A company is preparing its accounts to 30 April 2006. The latest telephone bill received by the company was dated 31 March and included call charges for the quarter 1 December to 28 February. The amount of the bill for call charges (excluding VAT) was $960. Most of the company's telephone bills are for similar amounts.

Which of the following journal entries should be made to the company's accounts at 30 April 2006?

The journal entries which should be made to the company's accounts at 30 April 2006 is

The statement of cash flow is a primary statement.

Which of the following gives the best description of the information provided to users by a statement of cash flow?

An audit trail is an essential part of an efficient, complete accounting system

Why is an audit trail important?

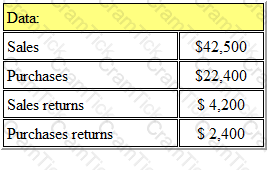

Refer to the Exhibit.

The correct ledger entry for payment of net wages to employees is:

The answer is:

Which THREE of the following internal controls are procedures to help detect errors?

Refer to the Exhibit.

A company operates a FIFO system of inventory valuation. The following information is available for the month of April:

The closing value of inventory at the end of the month of April is

Which one of the following internal controls is designed to prevent errors and fraud?

What will be the effect on the financial statements if the closing inventory figure is decreased?

MM does not maintain complete accounting records. The following information is available for the year ended 31 December 20X3:

The mark up on items sold by MM is 20%.

Which THREE of the following statements are true?

Which of the following would require an adjustment to be made to the cash book?

(a) Unpresented cheques

(b) Receipts not yet credited by the bank

(c) A dishonoured cheque

(d) Bank charges

The owner of a business takes goods from inventory for his own personal use

Which of the following accounting concepts would be relevant to this transaction?

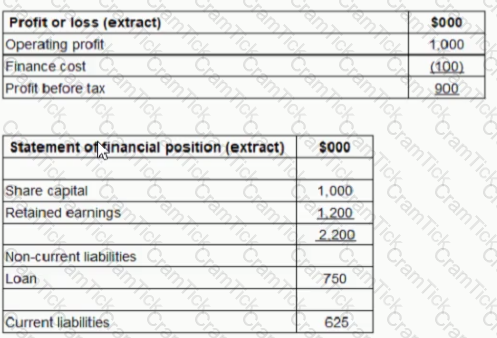

The following are extracts from CD's financial statements for the year to 31 December 20X2:

What is the return on capital employed percentage (ROCE) for CD for the year ended 31 December 20X2?

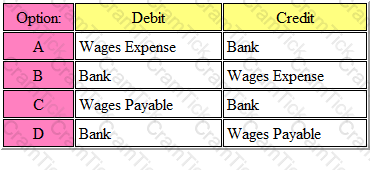

Refer to the Exhibit.

A company has the following transactions for an accounting period:

Closing inventory at the end of the period was $3,200 and gross profit was $16,400.

The opening inventory was therefore

Entity HJ is a small business. In the period. Entity Hj earned revenue of £24,300, had opening inventories of £1,500 and closing inventories of £8,000. Purchases came to £13,200.

What was Entity Hj's gross profit or loss for this period?

Refer to the Exhibit.

The following information is given at a manufacturer's year end:

Using some or all of the above figures, the correct figure for factory cost of goods completed is: