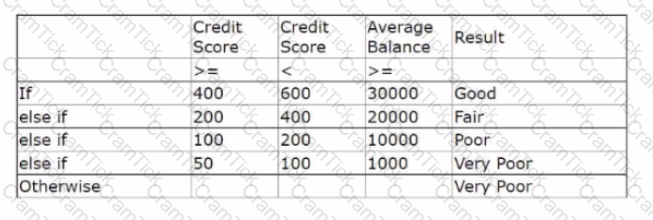

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning architect, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

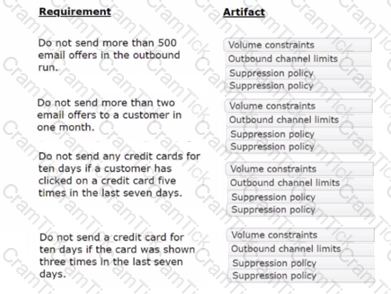

U+ Bank's marketing department currently promotes various credit card offers by sending emails to qualified customers. The bank wants to limit the number of offers that customers can receive over a given period of time.

In the Answer Area, select the correct artifact you use to implement each requirement.

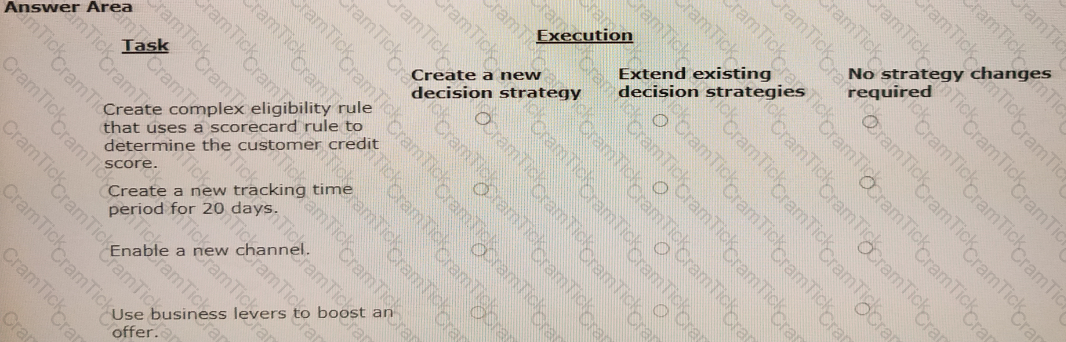

U+ Bank, a retail bank, presents offers on its website by using Pega Customer Decision Hub™. The bank wants to leverage Customer Decision Hub capabilities to present relevant offers to qualified customers. As a decisioning consultant, you are responsible for configuring the business requirements with the Next-Best-Action Designer, which involves several tasks. To accomplish these tasks, you might have to use auto-generated decision strategies, create new decision strategies, or edit existing strategies.

In the Answer Area, select the correct execution for each Task.

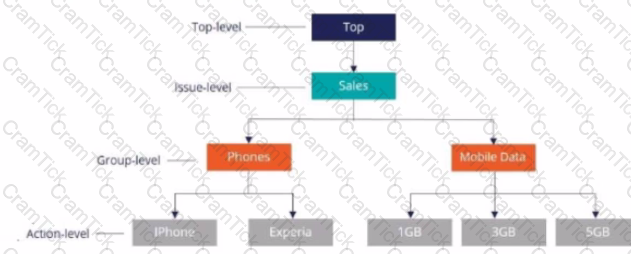

MyCo, a mobile company, uses Pega Customer Decision Hub™ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning architect, what must you do to present offers from the two groups?

U+ Bank wants to offer a Gold credit card to customers who have an annual income of more than USD150000. What do you configure in the Next-Best-Action Designer to achieve this outcome7

U+ Bank, a retail bank, has purchased Pega Customer Decision Hub. The bank currently uses an external tool to design email content and a third-party email service provider to send emails to its customers.

As a decisioning architect, how do you recommend the bank implements this requirement?

1yCo, a telecom company, wants to start promoting data plan offers through SMS to qualified customers. The marketing team needs to ensure that the outbound run always uses the latest customer information.

What do you configure to implement this requirement?

U+ Bank wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

Which of the following reasons explains why a customer might receive an action that they already accepted?

U+ Bank, a retail bank, uses the business operations environment to perform its business changes. The bank completes these changes by using revision management features of Pega Customer Decision Hub™ and 1:1 Operations Manager.

Customers see credit card offers based on various engagement policies on the U+ Bank website. The bank wants to update the underlying decision strategy of

an engagement policy condition.

According to best practices, which statement correctly describes the implementation of the change to fulfill this business requirement?

U+ Bank uses a scorecard rule in a decision strategy to compute the mortgage limit for a customer. U+ Bank updated their scorecard to include a new property in the calculation: customer income.

What changes do you need to make in the decision strategy for the updated scorecard to take effect?

Pega Customer Decision Hub enables organizations to make Next-Best decisions. To which type of a decision is Next-Best-Action applied?

A volume constraint uses the Return any action that does not exceed

constraint mode. The following tables show the configuration of the volume constraints and the list of customers in the outbound segment:

The outbound run selects customers in the following order to apply the volume constraints: CUST-01, CUST-02, CUST-03, and CUST-05.

Based on the configuration of the volume constraints for each channel, which offer does CUST-05 receive?

U+ Bank wants to use Pega Customer Decision Hub™ to display a credit card offer, the Standard Card, to every customer who logs in to the bank website. What three of the following artifacts are mandatory to implement this requirement7 (Choose Three)

The following decision strategy outputs the most profitable shoe a retailer can sell. The profit is the selling Prices of the shoe, minus the Cost to acquire the shoe.

The details of the shoes are provided in the following table:

The details of the shoes are provided in the following table:

To output the most profitable shoe, which component do you add in the blank space that is highlighted in red?