Explain the characteristics of strategic decisions. At what level of a business are strategic decisions made and why?

See the complete answer below in Explanation.

Characteristics of Strategic Decisions

Strategic decisions are long-term, high-impact choices that shape a company’s future direction. These decisions differ from operational and tactical decisions in several key ways:

Long-Term Focus– Strategic decisions determine the future direction of a business, often spanning several years.????Example: A company deciding to expand into international markets.

Significant Impact– They affect theentire organization, influencing growth, profitability, and market positioning.????Example: A shift from abrick-and-mortar retail modelto ane-commerce-based approach.

Resource Intensive– They requirelarge financial, human, and technological resourcesto implement.????Example: Investing inAI-driven supply chain automation.

High Risk and Uncertainty– These decisions involve considerable risks due tomarket changes, competition, and external factors.????Example: Entering an emerging market withregulatory and political risks.

Difficult to Reverse– Strategic decisions arenot easily changedwithout significant costs or consequences.????Example: Mergers and acquisitions require extensive planning and are challenging to undo.

Cross-Functional Involvement– They require input frommultiple departments(finance, marketing, operations, IT).????Example: A new product launch involvesR&D, marketing, supply chain, and finance teams.

Aimed at Gaining Competitive Advantage– The goal is to improve the company’smarket positionandlong-term success.????Example: Tesla’s focus onelectric vehicle technology and charging infrastructure.

At What Level Are Strategic Decisions Made?

Strategic decisions are made at thecorporate and business levels, typically by senior management and executives. Thethree levels of decision-makingin a company are:

1. Corporate-Level Decisions (Top Management)

Made by theCEO, Board of Directors, and Senior Executives.

Concerned with theoverall directionof the company.

Focuses onlong-term objectives, market expansion, mergers & acquisitions.

Example:Amazon’s decision to acquire Whole Foods to expand into the grocery industry.

2. Business-Level Decisions (Middle Management)

Made byDivisional Heads, Business Unit Managers, and Senior Functional Leaders.

Focuses onhow to compete effectively within a specific industry or market.

Covers areas such aspricing, product differentiation, and operational efficiency.

Example:Netflix shifting from a DVD rental business to a streaming service.

3. Functional-Level Decisions (Operational Managers)

Made byDepartment Heads, Operational Managers, and Team Leaders.

Concerned withday-to-day implementationof strategic and business-level plans.

Focuses onefficiency, productivity, and execution of company strategy.

Example:A supply chain manager optimizing inventory levels to reduce costs.

Why Are Strategic Decisions Made at the Corporate and Business Levels?

Require Vision and Expertise– Senior executives have thebig-picture perspectiveneeded for long-term planning.

Affect the Entire Organization– These decisions impact multiple departments, requiring cross-functional coordination.

High-Risk and Costly– Strategic choices involvefinancial investments, brand reputation, and market positioning.

Long-Term Focus– Corporate-level leaders ensure that decisions align with thecompany’s mission, vision, and goals.

Conclusion

Strategic decisions shape the company’s future, requiring careful planning, significant investment, and risk assessment. They aremade at the corporate and business levelsbecause theyimpact the entire organization, requireexpert leadership, and havelong-term consequences.

Discuss the role and influence of industry regulators and international bodies in the business environment.

See the complete answer below in Explanation.

The Role and Influence of Industry Regulators and International Bodies in the Business Environment

Introduction

Industry regulators and international bodies play acritical role in shaping the business environmentby enforcing regulations, setting industry standards, and ensuring fair competition. These organizations influence how businesses operate, impacting areas such astrade, finance, environmental sustainability, labor practices, and consumer protection.

Companies must comply with regulations set by bothdomestic industry regulatorsandglobal institutionsto maintain legal and ethical business operations.

1. Role of Industry Regulators

Industry regulators aregovernment-appointed or independent organizationsthat oversee specific sectors to ensure compliance with laws and standards. Their key functions include:

✅Enforcing Compliance– Ensuring companies adhere to legal requirements (e.g., financial reporting, safety regulations).✅Promoting Fair Competition– Preventing monopolies and anti-competitive practices.✅Consumer Protection– Safeguarding consumer rights and ensuring product/service quality.✅Regulating Market Entry and Operations– Setting standards for licensing, pricing, and ethical conduct.

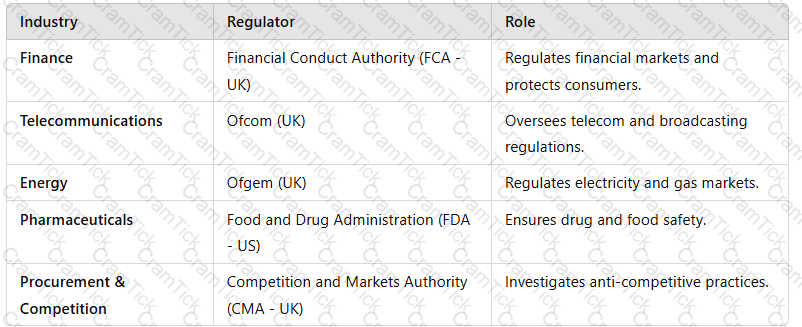

????Example of Industry Regulators

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

Case Example:TheUK’s Competition and Markets Authority (CMA)blockedMicrosoft’s acquisition of Activision Blizzarddue to concerns over market dominance in cloud gaming.

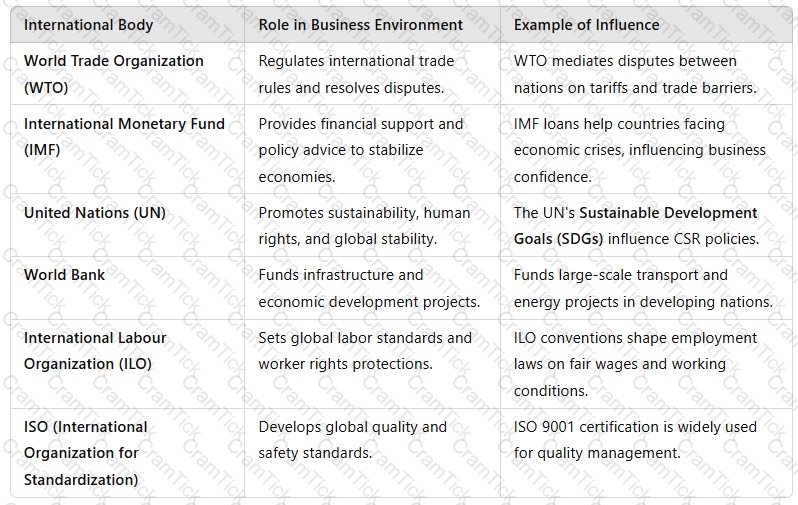

2. Role of International Bodies

International bodies setglobal regulations, trade policies, and ethical standardsthat influence businesses operating across borders.

A table with text on it

Description automatically generated

A table with text on it

Description automatically generated

Case Example:TheWTO’s intervention in Brexit trade negotiationsaffected tariffs and supply chain costs for UK-based companies.

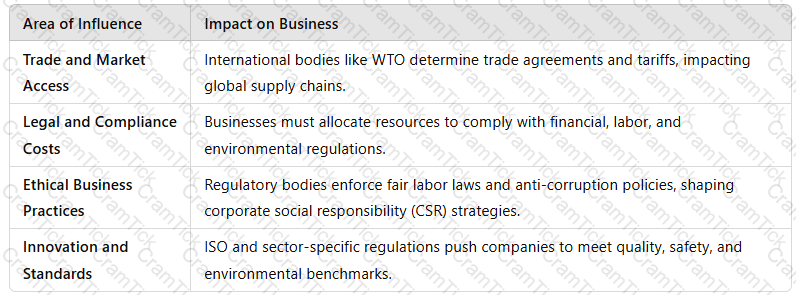

3. Influence of Industry Regulators and International Bodies on Business Strategy

Businesses must align their strategies with regulatory and international frameworks toensure compliance and avoid financial or reputational risks.

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

Example:TheEU’s General Data Protection Regulation (GDPR)forced global companies to enhancedata protection policiesor face heavy fines.

4. Advantages and Disadvantages of Regulatory and International Influence

✅Advantages

Promotes Stability & Fair Competition– Reduces market manipulation and corruption.

Protects Consumers & Employees– Ensures safety, fair wages, and ethical standards.

Encourages Innovation & Sustainability– Businesses invest in R&D to meet regulatory requirements.

Facilitates Global Trade– International trade agreements create business opportunities.

❌Disadvantages

Regulatory Burdens & Compliance Costs– Strict laws increase operational costs.

Trade Barriers & Bureaucracy– Lengthy regulatory approval processes slow down market entry.

Risk of Overregulation– Too many rules can stifle competition and innovation.

????Example:TheEU Emissions Trading System (EU ETS)requires manufacturers topay for carbon emissions, increasing operational costs.

Conclusion

Industry regulators and international bodiesshape the business environmentby enforcing laws, ensuring ethical practices, and facilitating global trade. Companies must proactivelymonitor regulatory changes, integrate compliance into strategic planning, and adapt to international standardsto maintain market competitiveness and sustainability.

Describe 5 strategic decisions a company can make and how these decisions could impact upon competitive advantage.

See the complete answer below in Explanation.

Five Strategic Decisions a Company Can Make and Their Impact on Competitive Advantage

Strategic decisions shape a company's direction and influence its long-term success. Below are five key strategic decisions and their impact oncompetitive advantage:

1. Market Entry Strategy

Decision:A company decides how to enter new markets (e.g., direct investment, joint ventures, exporting, franchising).

Impact on Competitive Advantage:✅Global Reach:Expanding into new markets increases revenue streams and reduces dependency on a single market.✅Risk Mitigation:Entering viajoint venturesoralliancescan reduce risks related to market unfamiliarity.✅Brand Positioning:Choosingpremium vs. cost-leadership entry strategiescan establish market dominance.❌Potential Risk:Poor market research can lead to financial loss and reputational damage.

Example:Tesla entering China through direct investment inGigafactoriesto strengthen its supply chain and reduce production costs.

2. Supply Chain Strategy

Decision:Whether to adopt aglobalized, localized, or hybridsupply chain model.

Impact on Competitive Advantage:✅Cost Reduction:Strategic sourcing fromlow-cost countrieslowers production expenses.✅Resilience:Adiverse supplier basereduces risks of disruptions (e.g., geopolitical risks, pandemics).✅Speed to Market:Nearshoring strategies improve lead times and response to demand fluctuations.❌Potential Risk:Over-reliance on global suppliers can lead to disruptions (e.g., semiconductor shortages).

Example:Apple’s dual sourcing strategy for chip manufacturing (Taiwan’s TSMC + US-based suppliers) improves resilience.

3. Innovation and R&D Investment

Decision:How much to invest inresearch and development (R&D)to drive product innovation.

Impact on Competitive Advantage:✅Differentiation:Unique and high-quality products create strong brand loyalty (e.g., iPhones, Tesla).✅First-Mover Advantage:Innovators set industry trends, making it difficult for competitors to catch up.✅Revenue Growth:New technologies create additional revenue streams (e.g., SaaS models in tech).❌Potential Risk:High R&D costs with no guaranteed success (e.g., Google Glass failure).

Example:Pfizer and BioNTech’s rapid COVID-19 vaccine development, giving them first-mover advantage.

4. Pricing Strategy

Decision:Whether to compete oncost leadership, differentiation, or premium pricing.

Impact on Competitive Advantage:✅Market Penetration:Low-cost pricing attractsprice-sensitivecustomers (e.g., Walmart, Ryanair).✅Brand Exclusivity:Premium pricing enhances brand perception and profitability (e.g., Rolex, Louis Vuitton).✅Value-Based Pricing:Aligning price with perceived value increases customer retention.❌Potential Risk:A race to the bottom in pricing wars can erode profit margins (e.g., budget airlines struggle with profitability).

Example:Apple uses apremium pricing strategywhile Xiaomi competes viacost leadershipin smartphones.

5. Digital Transformation Strategy

Decision:Investment inautomation, AI, and digital platformsto improve efficiency and customer engagement.

Impact on Competitive Advantage:✅Operational Efficiency:Automation reduces costs and increases productivity (e.g., Amazon’s AI-driven warehouses).✅Customer Experience:AI-driven personalization improves engagement (e.g., Netflix’s recommendation algorithms).✅Scalability:Digital platforms enable rapid global expansion (e.g., Shopify helping SMEs go digital).❌Potential Risk:High initial investment with slow ROI; risk of cyber threats.

Example:Starbucks using AI-poweredpersonalization and mobile orderingto increase sales and customer loyalty.

Conclusion

Each strategic decision influences a company’s competitive positioning. The most successful companies alignmarket expansion, supply chain strategies, innovation, pricing, and digital transformationto create asustainable competitive advantage.

Provide a definition of a commodity product. What role does speculation and hedging play in the commodities market?

See the complete answer below in Explanation.

Commodity Products and the Role of Speculation & Hedging in the Commodities Market

1. Definition of a Commodity Product

Acommodity productis araw material or primary agricultural productthat isuniform in quality and interchangeable with other products of the same type, regardless of the producer.

✅Key Characteristics:

Standardized and homogeneous– Little differentiation between producers.

Traded on global markets– Bought and sold on commodity exchanges.

Price determined by supply & demand– Subject to market fluctuations.

????Examples of Commodity Products:

Agricultural Commodities– Wheat, corn, coffee, cotton.

Energy Commodities– Crude oil, natural gas, coal.

Metals & Minerals– Gold, silver, copper, aluminum.

????Key Takeaway:Commodities areessential goods used in global trade, where price is the primary competitive factor.

2. The Role of Speculation in the Commodities Market????

Definition

Speculationinvolves buying and selling commoditiesfor profit rather than for actual use, based on price predictions.

✅How Speculation Works:

Traders and investorsbuy commodities expecting price increases(long positions).

Theysell commodities expecting price declines(short positions).

No physical exchange of goods—transactions are purely financial.

????Example:

A trader buyscrude oil futures at $70 per barrel, expecting prices to rise. If oil reaches$80 per barrel, the trader sells for profit.

Advantages of Speculation

✔Increases market liquidity– More buyers and sellers improve trading efficiency.✔Enhances price discovery– Helps determine fair market value.✔Absorbs market risk– Speculators take risks that producers or consumers avoid.

Disadvantages of Speculation

❌Creates excessive volatility– Large speculative trades can cause price spikes or crashes.❌Detaches prices from real supply and demand– Can inflate bubbles or cause artificial declines.❌Market manipulation risks– Speculators with large holdings can distort prices.

????Key Takeaway:Speculationadds liquidity and helps price discovery, butcan lead to extreme volatilityif unchecked.

3. The Role of Hedging in the Commodities Market????

Definition

Hedgingis arisk management strategyused by commodity producers and consumers toprotect against price fluctuations.

✅How Hedging Works:

Producers (e.g., farmers, oil companies)use futures contracts tolock in a pricefor future sales, reducing the risk of price drops.

Consumers (e.g., airlines, food manufacturers)hedge tosecure stable input costs, avoiding sudden price surges.

????Example:

An airline hedges against rising fuel costsby buying fuel futures at a fixed price for the next 12 months. If fuel prices rise, the airline is protected from increased expenses.

Advantages of Hedging

✔Stabilizes revenue and costs– Helps businesses plan with certainty.✔Protects against price swings– Reduces exposure to unpredictable market conditions.✔Encourages long-term investment– Producers and buyers operate with confidence.

Disadvantages of Hedging

❌Reduces potential profits– If prices move favorably, hedgers miss out on gains.❌Contract obligations– Hedgers must honor contract terms, even if market prices improve.❌Hedging costs– Fees and contract costs can be high.

????Key Takeaway:Hedgingprotects businesses from commodity price risk, ensuringstable revenue and cost control.

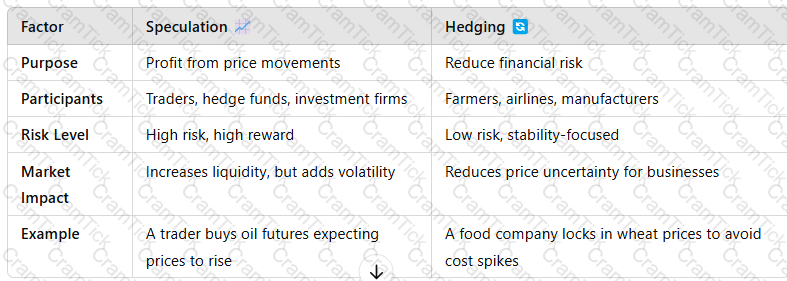

4. Speculation vs. Hedging: Key Differences

Key Takeaway:Speculationseeks profit from price changes, while hedgingminimizes risk from price fluctuations.

5. Conclusion

✅Commodity productsarestandardized raw materialstraded globally, with prices driven bysupply and demand dynamics.✅Speculationbrings liquidity and price discovery butcan increase volatility.✅Hedginghelpsbusinesses stabilize costs and revenues, ensuring financial predictability.✅Both strategies play essential rolesin ensuring abalanced, functional commodities market.

Assess benchmarking as an approach to analysing an organisations performance.

See the complete answer below in Explanation.

Benchmarking as an Approach to Analyzing Organizational Performance

Introduction

Benchmarking is aperformance measurement toolused by organizations tocompare their processes, products, or servicesagainst industry standards, competitors, or best practices. It helps organizationsidentify performance gaps, set improvement targets, and enhance competitive advantage.

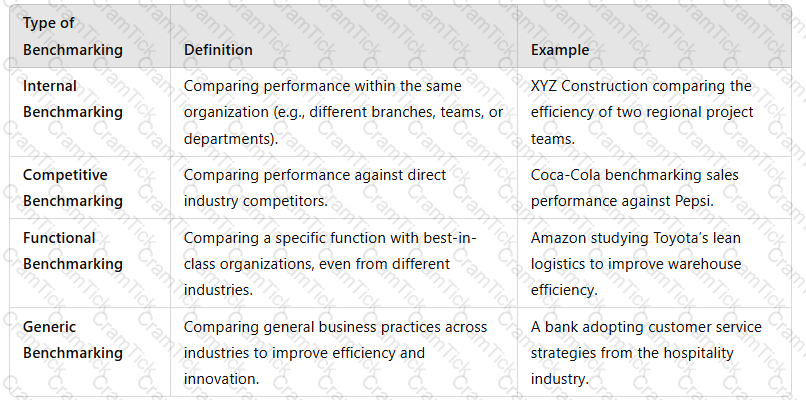

There are different types of benchmarking, includinginternal, competitive, functional, and generic benchmarking, each serving different strategic objectives.

1. Types of Benchmarking

Organizations can adopt different benchmarking approaches based on their goals:

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

2. How Benchmarking Helps in Performance Analysis

Benchmarking providesquantifiable insightsto assess and improve organizational performance in key areas:

✅Identifies Performance Gaps– Highlights areas where an organization lags behind competitors or industry best practices.✅Improves Operational Efficiency– Helps streamlinesupply chain, production, and customer service processes.✅Enhances Strategic Decision-Making– Supports data-driven decisions forresource allocation, pricing strategies, and process optimization.✅Drives Continuous Improvement– Encourages a culture ofinnovation and best practice adoption.✅Boosts Competitive Advantage– Enables organizations to stay ahead in their market by implementing superior processes.

????Example:Aretail chain benchmarking delivery speed against Amazonmay adoptAI-driven inventory managementto reduce delays.

3. Advantages of Benchmarking

✅Objective Performance Measurement– Uses industry data to providerealistic performance targets.✅Encourages Best Practice Adoption– Helps companieslearn from successful competitors.✅Enhances Cost Efficiency– Identifiesareas for cost reduction and resource optimization.✅Facilitates Strategic Growth– Helps companies improvecustomer experience, product innovation, and market positioning.

????Example:McDonald's benchmarked Starbucks' digital loyalty program, leading to the launch ofMyMcDonald’s Rewards, improving customer retention.

4. Limitations of Benchmarking

❌Limited to Available Data–Confidential industry datamay not always be accessible.❌Lack of Context– Differences inbusiness models, resources, and market conditionscanmake direct comparisons misleading.❌Focus on Imitation Over Innovation– Firms may focus too much oncopying competitorsrather than developing unique strategies.❌Resource-Intensive– Conducting in-depth benchmarking requirestime, expertise, and financial investment.

????Example:XYZ Construction benchmarking against a large multinationalmay find certain strategies unrealistic due toscale differences.

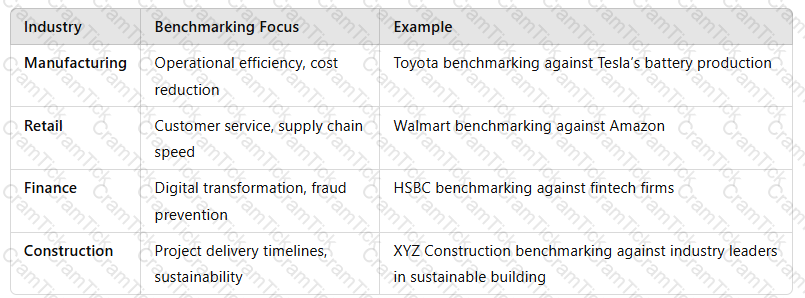

5. Application of Benchmarking in Different Sectors

Organizations across industries use benchmarking for performance analysis:

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

Conclusion

Benchmarking is aneffective performance analysis toolthat helps organizationsidentify gaps, adopt best practices, and enhance competitiveness. However, it must be used carefully toavoid blind imitation and consider contextual differences. When integrated with other strategic models (e.g., SWOT, Balanced Scorecard), benchmarking provides apowerful framework for continuous improvement and strategic growth.

XYZ is a manufacturing company based in the UK. It has a large complex supply chain and imports raw materials from Argentina and South Africa. It sells completed products internationally via their website. Evaluate the role of licencing and taxation on XYZ’s operations.

See the complete answer below in Explanation.

Evaluation of the Role of Licensing and Taxation on XYZ’s Operations

Introduction

Licensing and taxation play acritical role in international trade, supply chain management, and overall financial performance. For XYZ, aUK-based manufacturing companythat importsraw materials from Argentina and South Africaand sellsinternationally via an e-commerce platform, compliance with licensing and taxation regulations is essential to ensuresmooth operations, cost efficiency, and legal compliance.

This evaluation will assess theimpact of licensing and taxation on XYZ’s global supply chain, import/export activities, and financial performance.

1. The Role of Licensing in XYZ’s Operations

1.1 Import and Export Licensing Regulations

As XYZ importsraw materials from Argentina and South Africa, it must comply with theUK’s import licensing requirementsand trade agreements with these countries.

✅Impact on XYZ:

Import licensesmay be required for certain restricted raw materials (e.g.,metals, chemicals, agricultural products).

Export control lawsmay apply, depending on thedestination of final products.

Delays or finesmay occur if licenses are not properly managed.

????Example:If XYZ importsmetal componentssubject to UK trade restrictions, it mustsecure import licensesbefore shipment clearance.

1.2 Industry-Specific Licensing Requirements

Some industries requirespecial licensesto manufacture and sell products globally.

✅Impact on XYZ:

If XYZ manufactureselectronics or chemical-based products, it may need compliance certifications (e.g.,CE marking in the EU, FDA approval in the US).

Failure to meet licensing requirements canblock international sales.

????Example:A UK manufacturer sellingmedical devicesmust obtainMHRA (Medicines and Healthcare products Regulatory Agency) approvalbefore distributing products.

1.3 E-Commerce & Digital Sales Licensing

As XYZ sells its products internationally via itswebsite, it must comply with:✅Consumer Protection Laws(e.g., GDPR for EU customers).✅E-commerce business registrationand online sales regulations.

????Example:XYZ may need aVAT number in the EUif it sells products to European customers via its website.

2. The Role of Taxation in XYZ’s Operations

2.1 Import Duties and Tariffs

XYZ’s supply chain involvesimporting raw materials from Argentina and South Africa, which may attractimport duties and tariffs.

✅Impact on XYZ:

Higherimport duties increase raw material costsand impact profitability.

Tariff-free trade agreements(e.g., UK-South Africa trade deal)may reduce costs.

Post-Brexit UK-EU trade regulationsmay affect supply chain tax structures.

????Example:If theUK imposes high tariffs on South African goods, XYZ may need tofind alternative suppliers or negotiate better deals.

2.2 Corporate Tax & International Tax Compliance

XYZ must comply withUK corporate tax lawsand international taxation regulations.

✅Impact on XYZ:

Payingcorporate tax in the UKbased onglobal sales revenue.

Managinginternational tax obligationswhen selling in multiple countries.

Risk of double taxationif the same income is taxed in multiple jurisdictions.

????Example:If XYZ sells products inGermany and the US, it may need toregister for tax in those countriesand comply withlocal VAT/GST requirements.

2.3 Value Added Tax (VAT) & Sales Tax

Since XYZsells internationally via its website, it must adhere toglobal VAT and sales tax rules.

✅Impact on XYZ:

In theEU, VAT registration is required for online sales above a certain threshold.

In theUS, sales tax regulations varyby state.

Compliance withUK VAT laws (e.g., 20% standard rate)on domestic sales.

????Example:A UK company sellingonline to EU customersmust comply with theEU One-Stop-Shop (OSS) VAT scheme.

2.4 Transfer Pricing & Tax Efficiency

If XYZhas international subsidiaries or supply chain partners, it must managetransfer pricing regulations.

✅Impact on XYZ:

Ensuringfair pricing between UK operations and overseas supplierstoavoid tax penalties.

Optimizingtax-efficient supply chain structurestominimize tax burdens.

????Example:Multinational companies likeApple and Amazonusetax-efficient structuresto reduce liabilities.

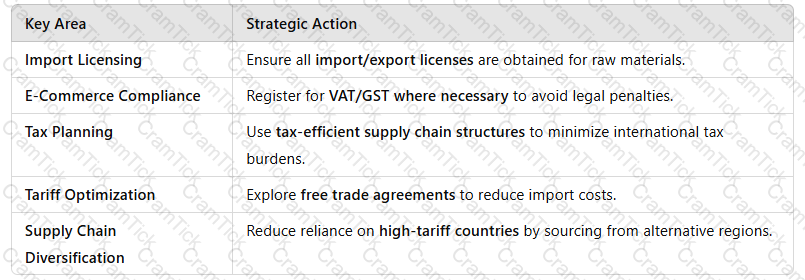

3. Strategic Actions for XYZ to Manage Licensing and Taxation Effectively

XYZ can take several steps tooptimize tax compliance and licensing efficiency:

A screenshot of a computer screen

Description automatically generated

A screenshot of a computer screen

Description automatically generated

Conclusion

Licensing and taxation have amajor impact on XYZ’s international manufacturing and e-commerce operations. To maintain profitability andregulatory compliance, XYZ must:

✅Ensureimport/export licensingaligns with UK and international trade laws.✅Manageimport duties, VAT, and corporate tax obligationseffectively.✅Optimize itssupply chain and tax planningto reduce costs.

By proactively managing these areas, XYZ canenhance its global competitiveness while minimizing risks.

Explain the use of forward and future contracts in the commodities market

See the complete answer below in Explanation.

Use of Forward and Futures Contracts in the Commodities Market

Introduction

Thecommodities marketinvolves the trading of physical goods such asoil, gold, agricultural products, and metals. Due toprice volatility, businesses and investors usederivative contractslikeforward and futures contractsto manage price risk and ensure stability in supply chains.

Both contracts allowbuyers and sellers to agree on a fixed price for a future date, but they differ in terms ofstandardization, trading methods, and risk exposure.

1. Forward Contracts????(Private, Custom Agreements)

Definition

Aforward contractis acustomized agreementbetween two parties tobuy or sell a commodity at a specified price on a future date. It is aprivate, over-the-counter (OTC) contract, meaning it isnot traded on an exchange.

✅Key Characteristics:

Customizable terms(quantity, delivery date, price).

Direct agreement between buyer and seller.

Used forhedging against price fluctuations.

????Example:Acoffee produceragrees to sell 10,000kg of coffee to a distributor in 6 months at afixed price of$5 per kg, protecting both parties from price swings.

Advantages of Forward Contracts

✔Tailored to buyer/seller needs– Customizable quantity, quality, and delivery terms.✔Reduces price uncertainty– Locks in a price, protecting against market fluctuations.✔No upfront cost– No initial margin or collateral required.

Disadvantages of Forward Contracts

❌High counterparty risk– If one party defaults, the other may face financial losses.❌Not regulated or publicly traded– Higher risk of contract disputes.❌Limited liquidity– Harder to transfer or sell compared to futures contracts.

????Best for:Companies looking forcustomized price protection in procurement or sales(e.g., food manufacturers, oil refineries).

2. Futures Contracts????(Standardized, Exchange-Traded Agreements)

Definition

Afutures contractis astandardized agreementto buy or sell a commodity at a predetermined price on a future date. These contracts aretraded on organized exchanges(e.g.,Chicago Mercantile Exchange (CME), London Metal Exchange (LME)).

✅Key Characteristics:

Highly regulated and standardized(fixed contract sizes and terms).

Exchange-traded→ Increased liquidity and price transparency.

Requiresinitial margin and daily settlements(mark-to-market system).

????Example:A wheat farmer usesfutures contracts on the Chicago Board of Trade (CBOT)to lock in wheat prices before harvest, avoiding potential price drops.

Advantages of Futures Contracts

✔Lower counterparty risk– Exchanges guarantee contract settlement.✔High liquidity– Easily bought or sold on futures markets.✔Price transparency– Publicly available pricing and standardized contracts.

Disadvantages of Futures Contracts

❌Less flexibility– Fixed contract sizes and expiration dates.❌Margin requirements– Traders must maintain a margin account, requiring cash reserves.❌Potential for speculative losses– Prices fluctuate daily, leading to possible margin calls.

????Best for:Large-scale buyers/sellers, investors, and companies needingrisk management in commodity markets.

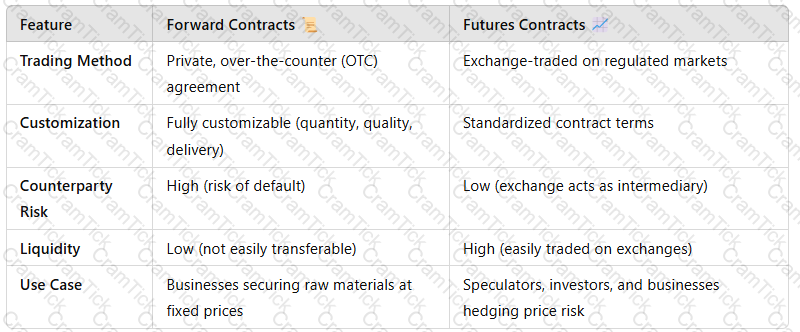

3. Key Differences Between Forward and Futures Contracts

A screenshot of a computer screen

Description automatically generated

A screenshot of a computer screen

Description automatically generated

Key Takeaway:Forwards offer flexibility but higher risk, whilefutures provide standardization and liquidity.

4. Application of Forward and Futures Contracts in the Commodities Market

Forwards Used By:

✅Food manufacturers– Locking in wheat, sugar, or coffee prices for future production.✅Oil refineries– Securing crude oil prices to manage fuel costs.✅Mining companies– Pre-agreeing on metal prices to secure revenue streams.

Futures Used By:

✅Airlines– Hedging against fluctuating fuel prices.✅Investors– Speculating on gold, oil, or agricultural prices for profit.✅Governments– Stabilizing national food or energy reserves.

5. Conclusion

Bothforward and futures contractsare essential tools in thecommodities marketforprice risk management.

✅Forward contractsarecustomizable but riskier, making them suitable forbusinesses with specific procurement needs.✅Futures contractsofferliquidity and reduced counterparty risk, making them ideal forinvestors and large corporations managing price volatility.

Organizations mustchoose the right contractbased on theirrisk tolerance, market exposure, and financial objectives.

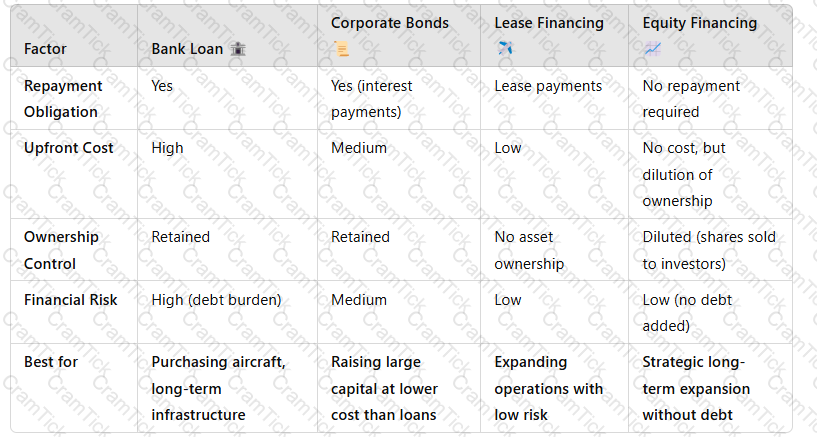

XYZ is a large and successful airline which is looking to expand into a new geographical market. It currently offers short haul flights in Europe and wishes to expand into the Asian market. In order to do this, the CFO is considering medium/ long term financing options.Describe 4 options that could be used.

See the complete answer below in Explanation.

Four Medium/Long-Term Financing Options for XYZ’s Expansion into Asia

Introduction

Expanding into anew geographical marketrequiressignificant capital investmentfornew aircraft, operational infrastructure, marketing, and regulatory approvals. As XYZ Airlines plans to enter theAsian market, the CFO must assessmedium and long-term financing optionsto fund this expansion while managing risk and financial stability.

The following arefour key financing optionsthat XYZ can consider:

1. Bank Loans (Term Loans)????

Definition

Abank term loanis a structured loan from a financial institution with afixed repayment period (typically 5–20 years), used for large-scale business investments.

✅Advantages✔Predictable repayment structure– Fixed or floating interest rates over an agreed period.✔Retains company ownership– Unlike equity financing, no shares are sold.✔Can be secured or unsecured– Flexible terms depending on company creditworthiness.

❌Disadvantages✖Requires collateral– Airlines often secure loans against aircraft or other assets.✖Fixed repayment obligations– Risky if revenue generation is slower than expected.✖Interest rate fluctuations– Increases costs if rates rise (for variable-rate loans).

????Example:

British Airways secured bank loansto fund new aircraft purchases.

????Best for:Large capital expenditures, such as purchasing aircraft for the new Asian routes.

2. Corporate Bonds????

Definition

Acorporate bondis adebt security issued to investors, where the company borrows capital and agrees topay interest (coupon) over timebefore repaying the principal at maturity (typically 5–30 years).

✅Advantages✔Large capital raise– Bonds can generate substantial long-term funding.✔Lower interest rates than bank loans– If the company has a strong credit rating.✔Flexibility in repayment– Interest payments (coupons) are pre-agreed, allowing financial planning.

❌Disadvantages✖High creditworthiness required– Investors demand a solid credit rating.✖Fixed interest costs– Even in poor revenue periods, interest payments must be met.✖Long approval and issuance process– Complex regulatory and underwriting procedures.

????Example:

Lufthansa issued corporate bonds to raise capital for fleet expansion.

????Best for:Funding fleet expansion or infrastructure development without immediate repayment pressure.

3. Lease Financing (Aircraft Leasing)✈️

Definition

Lease financing involvesleasing aircraft instead of purchasing them outright, reducing initial capital expenditure while maintaining operational flexibility.

✅Advantages✔Lower upfront costs– Avoids large capital outlays.✔More flexible than ownership– Can return or upgrade aircraft as market demand changes.✔Preserves cash flow– Payments are spread over time, aligning with revenue generation.

❌Disadvantages✖Higher long-term costs– Leasing is more expensive over the aircraft’s lifespan compared to ownership.✖Limited asset control– XYZ would not own the aircraft and must follow leasing conditions.✖Dependent on lessors’ terms– Strict maintenance and usage clauses.

????Example:

Ryanair and Emirates use operating leases to expand their fleets cost-effectively.

????Best for:Entering new markets with minimal financial risk, allowing XYZ to test the Asian market before making major capital investments.

4. Equity Financing (Share Issuance)????

Definition

Equity financing involves raising funds byissuing new company shares to investors, providing long-term capital without repayment obligations.

✅Advantages✔No repayment burden– Unlike debt, there are no interest payments or fixed obligations.✔Enhances financial stability– Reduces leverage and improves balance sheet strength.✔Can attract strategic investors– Airlines may raise capital frompartners or industry investors.

❌Disadvantages✖Dilutes ownership– Existing shareholders lose some control.✖Time-consuming approval process– Requires regulatory compliance and investor confidence.✖Market dependence– Success depends on stock market conditions.

????Example:

IAG (British Airways' parent company) raised capital via a share issuance to fund expansion.

????Best for:Companies looking for long-term funding without increasing debt, especially if stock market conditions are favorable.

5. Comparison of Financing Options

Key Takeaway:Each financing option suits different strategic needs, from ownership-based expansion to flexible leasing.

6. Recommendation: Best Financing Option for XYZ’s Expansion

✅Best Option: Lease Financing (Aircraft Leasing)✈️

Minimizes financial riskwhile expanding into Asia.

Avoids large upfront costs, preserving cash for operations.

Allows flexibilityif the new market underperforms.

Alternative Approach: Hybrid Strategy

Lease aircraft initially→ Test the Asian market.

Issue corporate bonds later→ Secure long-term funding for growth.

Consider equity financingif a strategic investor is interested.

????Final Takeaway:A combination ofleasing for operational flexibilityandcorporate bonds or equity for long-term financial strengthis the best approach for XYZ’s expansion into Asia.

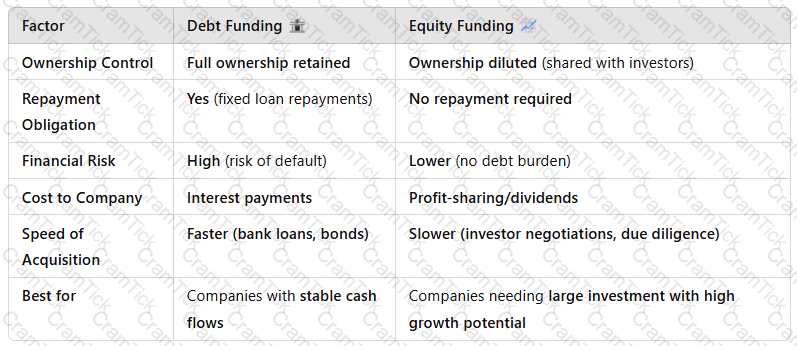

XYZ is a successful cake manufacturer and wishes to expand the business to create additional confectionary items. The expansion will require the purchase of a further manufacturing facility, investment in machinery and the hiring of more staff. The CEO and CFO are confident that the diversification will be a success and are discussing ways to raise funding for the expansion and are debating between dept funding and funding.What are the advantages and disadvantages of each approach?

See the complete answer below in Explanation.

Evaluation of Debt Funding vs. Equity Funding for XYZ’s Expansion

Introduction

As XYZ, a successfulcake manufacturer, plans to expand intoadditional confectionery items, it requires significant investment ina new manufacturing facility, machinery, and staff. To finance this expansion, the company must choose between:

Debt Funding– Borrowing from banks or financial institutions.

Equity Funding– Raising capital by selling shares to investors.

Each funding option hasadvantages and disadvantagesthat impactfinancial stability, ownership control, and long-term business strategy.

1. Debt Funding????(Loans, Bonds, or Credit Facilities)

Definition

Debt funding involvesborrowing moneyfrom banks, lenders, or issuing corporate bonds, which must be repaid with interest.

✅Key Characteristics:

The company retainsfull ownership and decision-making control.

Loan repayments are fixed and predictable.

Interest payments aretax-deductible.

????Example:XYZ takes abank loan of £2 millionto purchase new machinery and repay it over five years with interest.

Advantages of Debt Funding

✔Ownership Retention– XYZ keeps full control over business decisions.✔Predictable Repayment Plan– Fixed monthly payments make financial planning easier.✔Tax Benefits– Interest paymentsreduce taxable income.✔Shorter-Term Obligation– Once the loan is repaid, there are no further obligations.

Disadvantages of Debt Funding

❌Repayment Pressure– Regular repaymentsincrease financial riskduring slow sales periods.❌Interest Costs– High-interest rates canreduce profitability.❌Collateral Requirement– Lenders may requirecompany assets as security.❌Credit Risk– If XYZ fails to repay, it riskslosing assets or damaging credit ratings.

????Best for:Companies that want tomaintain ownership and have stable revenue streamsto cover repayments.

2. Equity Funding????(Selling Shares to Investors or Venture Capitalists)

Definition

Equity funding involvesraising capital by selling sharesin the company to investors, such asprivate investors, venture capitalists, or the stock market.

✅Key Characteristics:

No repayment obligations, but shareholders expect areturn on investment (ROI).

Investorsgain partial ownershipand may influence business decisions.

Funding amount depends on the company’svaluation and investor interest.

????Example:XYZ sells20% of its shares to a private investor for £3 million, which funds new production lines.

Advantages of Equity Funding

✔No Repayment Obligation– Reduces financial burden on cash flow.✔Access to Large Capital– Easier to raise significant funds for expansion.✔Attracts Strategic Investors– Investors may provide expertise and industry connections.✔Spreads Business Risk– Losses are shared with investors, reducing pressure on XYZ.

Disadvantages of Equity Funding

❌Loss of Ownership & Control– Investors gain a say in company decisions.❌Profit Sharing– Dividends or profit-sharing reduce earnings for existing owners.❌Longer Decision-Making Process– Raising equity capital takes time due to negotiations and regulatory compliance.❌Dilution of Shares– Selling shares reduces the founder’s ownership percentage.

????Best for:Companies needinglarge funding amounts with less repayment pressure, but willing toshare ownership and decision-making.

3. Comparison: Debt vs. Equity Funding

A screenshot of a computer screen

Description automatically generated

A screenshot of a computer screen

Description automatically generated

Key Takeaway:The choice betweendebt and equity fundingdepends on XYZ’srisk tolerance, cash flow stability, and long-term growth strategy.

4. Conclusion & Recommendation

Bothdebt funding and equity fundingoffer advantages and risks for XYZ’s expansion.

✅Debt fundingis ideal if XYZ wants toretain ownership and has stable revenueto cover loan repayments.✅Equity fundingis better if XYZ seekslarger investments, strategic expertise, and reduced financial risk.

????Recommended Approach:Ahybrid strategy, combiningdebt for short-term capital needsandequity for long-term growth, can providefinancial flexibility while minimizing risks.

TESTED 03 Apr 2025

Copyright © 2014-2025 CramTick. All Rights Reserved