Financial Strategy

Last Update Apr 3, 2025

Total Questions : 435 With Methodical Explanation

Why Choose CramTick

Last Update Apr 3, 2025

Total Questions : 435

Last Update Apr 3, 2025

Total Questions : 435

Customers Passed

CIMA F3

Average Score In Real

Exam At Testing Centre

Questions came word by

word from this dump

Try a free demo of our CIMA F3 PDF and practice exam software before the purchase to get a closer look at practice questions and answers.

We provide up to 3 months of free after-purchase updates so that you get CIMA F3 practice questions of today and not yesterday.

We have a long list of satisfied customers from multiple countries. Our CIMA F3 practice questions will certainly assist you to get passing marks on the first attempt.

CramTick offers CIMA F3 PDF questions, and web-based and desktop practice tests that are consistently updated.

CramTick has a support team to answer your queries 24/7. Contact us if you face login issues, payment, and download issues. We will entertain you as soon as possible.

Thousands of customers passed the CIMA Financial Strategy exam by using our product. We ensure that upon using our exam products, you are satisfied.

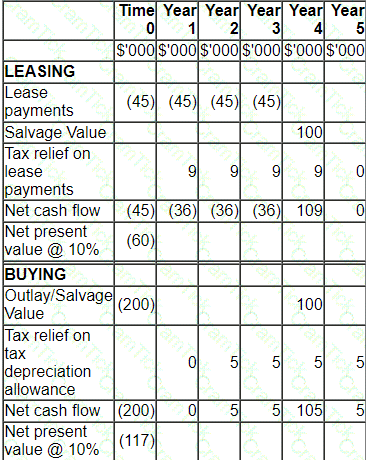

A company plans a four-year project which will be financed by either an operating lease or a bank loan.

Lease details:

• Four year lease contract.

• Annual lease rentals of $45,000, paid in advance on the 1st day of the year.

Other information:

• The interest rate payable on the bank borrowing is 10%.

• The capital cost of the project is $200,000 which would have to be paid at the beginning of the first year.

• A salvage or residual value of $100,000 is estimated at the end of the project's life.

• Purchased assets attract straight line tax depreciation allowances.

• Corporate income tax is 20% and is payable at the end of the year following the year to which it relates.

A lease-or-buy appraisal is shown below:

Which THREE of the following items are errors within the appraisal?

The Board of Directors of Company T is considering a rights issue to fund a new investment opportunity which has a zero NPV.

The Board of Directors wishes to explain to shareholders what the theoretical impact on their wealth will be as a result of different possible actions during the rights issue.

Which THREE of the following statements in respect of theoretical shareholder wealth are true?

A company is reporting under IFRS 7 Financial Instruments: Disclosures for the first time and the directors are concerned about whether this will lead to the disclosure of information that could affect the company's share price.

The company is based in a country that uses the A$ but 40% of revenue relates to export sales to the USA and priced in US$.

When the company reports under IFRS 7 for the first time, the share price is most likely to: