Which TWO of the following are true in relation to IAS21 The Effects of Changes in Foreign Exchange Rates when consolidating an overseas subsidiary?

ST has in issue unquoted 7% debentures which were issued at par and are redeemable in 1 year's time. These debentures cannot be traded. The yield to maturity on these debentures has been calculated at 5%.

Which of the following would explain why the yield to maturity is lower than the coupon?

LK acquired 100% of the equity shares of TU on 1 January 20X4. LK disposed of 60% of TU for £2,400,000 on 30 September 20X4. The sale proceeds reflected the fair value of TU's shares on that date.

The remaining 40% shareholding gave LK the ability to exercise significant influence over the activities of TU. TU reported profit of $1,800,000 for the year ended 31 December 20X4 and this accrued evenly throughout the year.

Calculate the investment in associate that will be presented in LK's consolidated statement of financial position as at 31 December 20X4.

Give your answer to the nearest whole $'000.

$ 000

On 1 January 20X7 GH purchased plant and equipment at a cost of $400,000. The temporary differences in respect of this plant and equipment at 31 December 20X7 and 20X8 have been calculated as follows:

Assume that there are no other temporary differences in the periods and that the corporate income tax rate is 25%. GH is expected to have significant taxable profits in the future.

Which of the following is the correct impact in GH's statement of financial position at 31 December 20X8 in respect of deferred tax?

A group presents its financial statements in A$.

The goodwill of its only foreign subsidiary was measured at B$100,000 at acquisition. There have been no impairments to this goodwill.

Exchange rates (where A$/B$ is the number of B$'s to each A$) are as follows:

The value of goodwill to be included in the group's statement of financial position in respect of its foreign subsidiary for the year ended 31 December 20X4 is:

AB has taxable temporary differences arising from the revaluation of non current assets.

What is the journal entry to record the movement in the provision for deferred tax resulting from this difference?

When accounting for a finance lease under IAS 17 Leases, which TWO of the following are recognised in the statement of profit or loss?

KL acquired 75% of the equity share capital of MN on 1 January 20X8. The group's policy is to value non-controlling interest at fair value at the date of acquisition. MN acquired 60% of the equity share capital of PQ on 1 January 20X9 for $360 million.

At 1 January 20X9 the fair value of the non-controlling interest in PQ was $220 million and the fair value of the net assets of PQ at 1 January 20X9 were $320 million.

Calculate the goodwill arising on the acquisition of PQ at 1 January 20X9.

Give your answer to the nearest million.

$ ? million

On 1 January 20X4 JK had 1,500,000 ordinary shares in issue. On 1 September 20X4 JK issued 600,000 ordinary shares at the market value of $2.50 a share. For the financial year ended 31 December 20X4 the statement of profit or loss shows profit before tax of $625,000 and profit after tax of $500,000.

What is the earnings per share for the year ended 31 December 20X4?

CD commenced a construction contract on 1 April 20X9. The contract value was agreed at $100,000. CD had incurred $40,000 costs to date and estimated costs to completion were $50,000. At the year ended 31 December 20X9 this contract was estimated to be 60% complete. CD adopted the provisions of IAS 11 Construction Contracts when preparing its financial statements for the year to 31 December 20X9.

What value should be included in CD's profit for the year ended 31 December 20X9 in respect of this contract?

Give your answer to the nearest whole number.

$ ?

AB and CD are competitors supplying components to the car manufacturing industry. AB operates in Country X and CD operates in Country Y. Both entities were incorporated on the same day, are the same size and prepare financial statements to 31 March each year using international accounting standards.

Which of the following statements taken individually would limit the usefulness of the comparison of the return on capital employed ratio between the two entities?

HJ is currently in dispute with an employee, who is claiming $400,000 in a legal case against them.

HJ's legal advisors have stated that it is probable that they will lose the case and will have to pay the amount claimed.

Also, HJ are claiming $250,000 from a supplier of defective goods and the legal advisors have stated that it is probable that HJ will be successful in this claim.

What is the correct accounting treatment for these two items in HJ's financial statements?

ST acquired 70% of the equity shares of DE for $87,500 on 30 September 20X5. At the date of acquisition the net assets of DE were $54,700 and the fair value of the non controlling interest was measured at $19,700. There has been no impairment of goodwill.

On 30 September 20X9 ST disposed of its entire investment in DE for $262,500 when the net assets of DE were $96,250.

What is the gain or loss on disposal of DE that will be included in ST's consolidated profit or loss for the year ended 30 September 20X9?

Calculate the value of non controlling interest that will be presented in KL's consolidated statement of financial position at 31 December 20X9?

Give your answer to the nearest whole $'000.

$ ? 000

Which of the following actions would be most likely to improve an entity's gross profit margin?

KL sells luxury leather handbags and has 3 stores in exclusive shopping areas. Following years of static revenues and margins, in August 20X6 KL opened a fourth store at a busy airport terminal which is proving to be successful.

The revenue and gross profit of KL for the years ended 31 March 20X7 and 20X6 are as follows:

Which of the following would be a contributing factor to the movement in the gross profit margin of KL?

AB acquired an investment in a debt instrument on 1 January 20X5 at its nominal value of $25,000, which it intends to hold until maturity. The instrument carried a fixed coupon interest rate of 5%, payable in arrears. Transactions costs of $5,000 were paid in respect of this investment. The effective interest rate applicable to this instrument was estimated at 9%.

Calculate the value of this investment that AB will include in its statement of financial position at 31 December 20X5.

Give your answer to the nearest whole number.

$ ?

A local council is one year into a two year project to renovate local parks. The project is on track to be completed within the set time-scale, however it has proved more costly than initially expected.

The project is on track to be completed within its two year period. Contracts for the labour and materials needed to renovate the parks were agreed at the start of the project and no changes have arisen. Despite the fact

that the council has yet to fully settle these contracts, costs are set to be as budgeted.

Why would this example not be recognised as a provision?

AAA is the only director of entity CD. AAA is also a director of entity GH. CD owns 30% of the equity of MN and 60% of the equity of OP.

Identify which of the following are related parties of CD by placing the appropriate response against one.

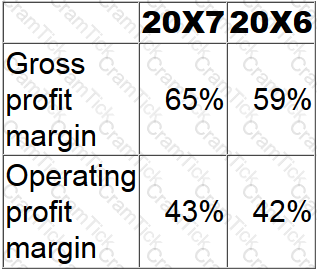

Ratios calculated from the financial statements of ST Group for the years ended 31 August 20X7 and 20X6 are as follows:

Which of the following would have contributed to the movements in these ratios?

XY puchased 2% of the equity shares of FG on 1 October 20X3.

XY paid $25,000 for the shares as well as a transaction cost of 2.5% of the purchase price.

The shares are being held for short term trading and XY intend to sell them in December 20X3.

At the year end of 31 October 20X3, the shares in FG could be sold for $28,000.

What is the journal entry to record the subsequent measurement for this investment at 31 October 20X3?

EF obtained a government licence, free of charge, to operate a silver mine in 20X7 and $5 million was spent on preparing the site. The mine commenced operation on 1 January 20X8. The licence requires that at the end of the mine's useful life of 20 years, the site above ground must be reinstated to its original position.

EF estimated that the cost in 20 years' time of this reinstatement will be $3 million, which has a present value of $1 million at 1 January 20X8.

Which THREE of the following describe how the cost of the reinstatement of the site should be treated in the financial statements of EF in the year ended 31 December 20X8?

LM and JK operate in the same country and prepare their financial statements to 30 June 20X6 in accordance with International Accounting Standards. On 27 June 20X6 both entities raised $1 million cash by issuing debt instruments with identical terms and conditions. Prior to this issue both entities were financed entirely by equity.

At 30 June 20X6 the gearing ratios, calculated as Debt/Equity x 100%, were as follows:

LM: 30%

JK: 65%

Which of the following independent options would explain the difference between LM and JK's year-end gearing?

KL issued $100,000 of 6% convertible debentures at par on 1 January 20X7. These debentures are redeemable at par or can be converted into 5 shares for each $100 of nominal value of debentures on 31 December 20X9.

The share price on 1 January 20X7 is $18 a share. The share price is expected to grow at a rate of 7% a year.

The expected redemption value for each $100 nominal value of debentures on the date of conversion is:

AB owned 80% of the equity share capital of FG at 1 January 20X6. AB disposed of 10% of FG's equity share capital on 31 December 20X6 for $400,000. The non controlling interest was measured at $700,000 immediately prior to the disposal.

Which of the following represents the adjustment that AB made to non controlling interest in respect of the disposal when it prepared its consolidated financial statements at 31 December 20X6?

GH acquired 3,000,000 of the 12,000,000 equity shares of JK. All shares carried equal voting rights and no other single shareholder of JK held more than 10% of the equity shares. GH has the power to participate in the financial and operating policy decisions but not control them.

Based on the information provided above, how would GH's investment in JK be accounted for in its consolidated financial statements?

Which TWO of the following are relevant ethical considerations when selecting an accounting policy?

The dividend yield of ST has fallen in the year to 31 May 20X5, compared to the previous year.

The share price on 31 May 20X4 was $4.50 and on 31 May 20X5 was $4.00. There were no issues of share capital during the year.

Which of the following should explain the reduction in the dividend yield for the year to 31 May 20X5 compared to the previous year?

XY's investments enable it to exercise control over AB and have significant influence over FG and JK.

The Managing Director of XY is a non-executive director of LM. XY does not hold any investment in LM.

XY is preparing its consolidated financial statements for the year ended 30 September 20X9.

Which of the following transactions during the year will be disclosed in these financial statements in accordance with IAS 24 Related Party Disclosures?

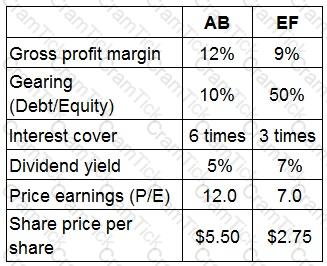

AB and EF are located in the same country and prepare their financial statements to 31 October in accordance with International Accounting Standards. EF supplies AB with a component that is vital to AB's product range. AB is considering acquiring a controlling interest in EF by 31 December 20X4 in order to guarantee future supply. The Board of EF has indicated that such an approach would be postively considered. AB would use its control to make AB the sole customer of EF.

The Finance Director of AB has been granted access to EF's management accounts and has conducted some initial analysis from the financial press. The results togther with comparisons for AB for the year to 31 October 20X4 are presented below:

AB and EF are forecasting revenues of S1,500,000 and $700,000 respectively for the year ended 31 October 20X5.

AB's Finance Director met with one of the directors of EF to discuss the potential impact of the acquisition.

Which of the director's statements below is correct?

XY owned 80% of the equity share capital of AB at 1 January 20X5. XY disposed of 20% of AB's equity share capital on 31 December 20X5 for $200,000. The non controlling interest was measured at $140,000 immediately prior to the disposal.

What was the amount of the credit to retained earnings that XY will process in respect of this disposal when it prepares its consolidated financial statements at 31 December 20X5?

On 1 January 20X7 GH purchased plant and equipment at a cost of $400,000. The temporary differences in respect of this plant and equipment at 31 December 20X7 and 20X8 have been calculated as follows:

Assume that there are no other temporary differences in the periods and that the corporate income tax rate is 25%. GH is expected to have significant taxable profits in the future.

Which of the following is the correct impact in GH's statement of financial position at 31 December 20X8 in respect of deferred tax?

Which of the following statements are true regarding consolidated cash flows after the acquisition of a subsidiary?

Select ALL that apply.

JK is seeking to raise new finance through a rights issue of equity shares.

Which THREE of the following statements are correct?

FG acquired 75% of the equity share capital of HI on 1 September 20X3.

On the date of acquisition, the fair value of the net assets was the same as the carrying amount, with the exception of a contingent liability disclosed by HI and relating to a pending legal case. At 1 September 20X3, the contingent liability was independently valued at $1.2 million.

At the current year end, 31 March 20X5, the legal case is still outstanding. The fair value of the liability has now been estimated at $1.4 million, and the case is expected to be resolved in the forthcoming financial year.

How should this contingent liability be recorded in the consolidated financial statements for the year ended 31 March 20X5?

What is the total comprehensive income attributable to the shareholders of GHI that will be presented in GHI's consolidated statement of changes in equity for the year ended 31 December 20X4?

LK acquired 100% of the equity shares of TU on 1 January 20X4. LK disposed of 60% of TU for £2,400,000 on 30 September 20X4. The sale proceeds reflected the fair value of TU's shares on that date.

The remaining 40% shareholding gave LK the ability to exercise significant influence over the activities of TU. TU reported profit of $1,800,000 for the year ended 31 December 20X4 and this accrued evenly throughout the year.

Calculate the investment in associate that will be presented in LK's consolidated statement of financial position as at 31 December 20X4.

Give your answer to the nearest whole $'000.

$ 000