The general term that describes the ability for employees to make changes to certain data in their own records within the payroll or HR system is called:

An environment n which the back office transaction-intensive processes and customer care functions are consolidated is known as:

Sally's department was scheduled to work from 8:00 a.m. until 5:00 p.m. It was announced to all employees that a severe winter storm was expected to reach the city between 4:00 p.m. and 5:00 p.m. Employees of Sally's department asked if they, like most other departments, would be allowed to leave work at 3:00 p.m. to avoid being caught in the storm. Sally was sympathetic, but after much discussion denied the request, stating that the policy was clear that employees were to remain on duty until 5:00 p.m. Which of the following management styles is Sally demonstrating?

Under NACHA rules, employers are advised to retain a copy of the employee's written authorization for direct deposit for at least:

Which of the following agencies would most likely enforce rules governing the number of days following the close of the payroll period that employees must be paid?

The FLSA requires which of the following records to be retained for three years?

Which of the following items represents an input interface to the payroll system?

Federal tax withheld from a distribution of $50,000 from a qualified retirement plan paid directly to a retiree age 65 is:

Which of the following would most likely be a key step in reconciling a payroll withholding account?

Which of the following best represents compliance under Section 404 of Sarbanes Oxley?

Which of the following would not be included in the system testing stage of an implementation?

Copies of the production files and most recent payroll transactions are sent nightly to the parent company in a remote location. this practice is part of what type of plan?

The rate of withholding in 2009 on qualified pension distributions made directly to employees is:

An employer that deposits payroll taxes semiweekly incurs a tax liability of $55,000 on Tuesday and a liability of $110,000 on Wednesday. When should the taxes be deposited?

Beth, who works for Nugget Productions, is enrolled in the company's cafeteria plan. Beth adopts a child in august, and requests a change in her election under the cafeteria plan. What is the action that may be taken?

A U.S. citizen working for a foreign employer outside the United States is subject to which of the following taxes?

In 2009, employee Chris was transferred from her company's headquarters to a distribution center 1,000 miles away. The company reimbursed her for meal expenses totaling $100 and lodging expenses totaling $300 incurred while driving from her old residence to her new. Chris' company directly paid the moving company $2,000 for transporting her household goods. What portion of Chris' employer-paid relocation expenses is reported in box 1, "wages, tips, other compensation?"

Documenting payroll policies and procedures will provide all of the following results EXCEPT:

The final due date for the second quarter Form 941, assuming that the employer paid all taxes on time is:

If an employee working abroad with a tax home in a foreign country passes the "physical presence test," to what may the employee be eligible?

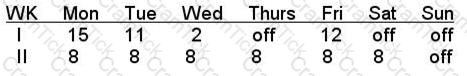

Under FLSA, how many hours must be paid at the overtime rate of pay for the following biweekly period assuming the employer is a hospital qualified under the special provisions of the FLSA?

In 2010, an individual worked for three employers during the calendar year, earning $38,000, $39,000, and $35,000 respectively. What is the total amount of social security and Medicare taxes that should be withheld from the employee's wages by the three employers?

Assuming that the moving expense was incurred in 2009, which of the following expense reimbursements is excludable from gross income?

For IRS purposes, the payroll register should be retained for a period of not less than how many years?

Using federal child support guidelines, calculate the maximum amount of support that can be withheld from an employee's semimonthly disposable earnings of $1,500.00. The employee is four months in arrears in making child support payments and has no other dependents.

American Planning Association | CPP-Remote Questions Answers | CPP-Remote Test Prep | Certified Payroll Professional Questions PDF | CPP-Remote Online Exam | CPP-Remote Practice Test | CPP-Remote PDF | CPP-Remote Test Questions | CPP-Remote Study Material | CPP-Remote Exam Preparation | CPP-Remote Valid Dumps | CPP-Remote Real Questions | American Planning Association CPP-Remote Exam Questions