A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

Resource planning must take all of the following into account except:

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

Fred Fiedler's contingency model suggests that:

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

A cyclical process model was chosen as the basis for total cost management (TCM) because:

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Assuming the average life span of a lithium battery is two years and is normally distributed with a standard deviation of two months, what is the probability the battery will last between 20 months and 26 months?

After collecting the control information on a light rail project within an original budget of 200.0OO work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor is 60%.

After collecting the control information on a light rail project within an original budget of 200.000work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor Is 60%.

Is the percent complete stated by the contractor correct?

Productivity increases with time. This improvement is commonly associated with improvements in efficiency brought about by increased experience and skill levels. What does this scenario describe?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Annual estimated tax would be:

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve. Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assume money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

If $10,000 is invested now at 10% compounded annually, what will the investments be worth 10 years from now?

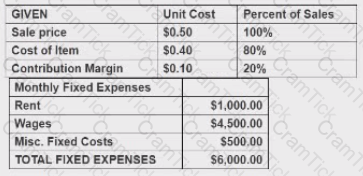

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

Marketing has determined that XY2 can safely increase their per unit selling price to SO.55. The new break even amount for sales (in units) based on the new contribution margin is:

An effort by a prime contractor to reduce the price quoted by a vendor, by providing the bid price to other vendors in an attempt to get the other vendors to underbid the original price quoted is referred to as:

What relationship more accurately defines a situation model of parallel activities that require a partial start of one activity?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Which of the following calculations would not be needed to determine "net income?'

If you deposit $100 per month for two (2) years and earn interest at 12% APR (Annual Percentage Rate) compounded monthly, how much will you have at the end of the period?

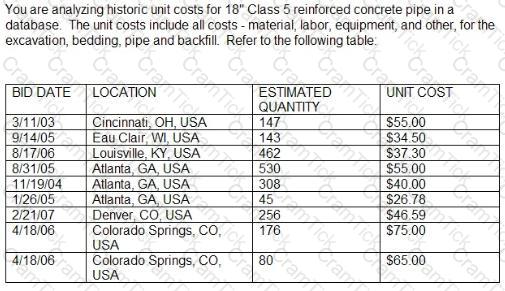

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the relative frequency of unit costs amounting to $55.00/unit?

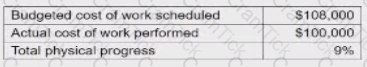

A small hole construction project has a baseline budget of $1,000,000. The project is scheduled to be constructed in 12 months. At the and of the first month, the project data is reported as below:

The following question requires your selection of Scenario 1.4.162 from the right side of your split screen, using the drop down menu, to reference during your response/choice of response.

The budgeted cost work performed is;

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

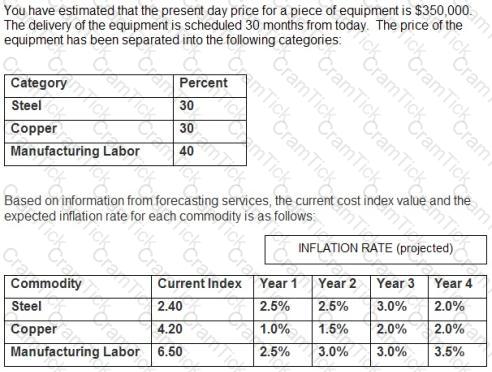

The following question requires your selection of CCC/CCE Scenario 26 (2.5.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Why is a +/- notation necessary when developing an estimate?

When a person hears the words being said to him/her, but does not receive the message of the words, it is called

A systematic coding structure for organizing and managing scope, assets, cost, resources, work and schedule activity information is a______________.

AACE International defines _____________as a technique of economic evaluation that sums over a given study period, the costs of initial investment, replacements, operations, and maintenance/repair; expressed in either present or annual value terms.

Which of the following is a disadvantage to using target contract as a method of contracting?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Based on the information provided, which statement is most correct?

When measuring progress using tasks that lack readily definable intermediate milestones and level of effort required is difficult to measure, the best methods to use is:

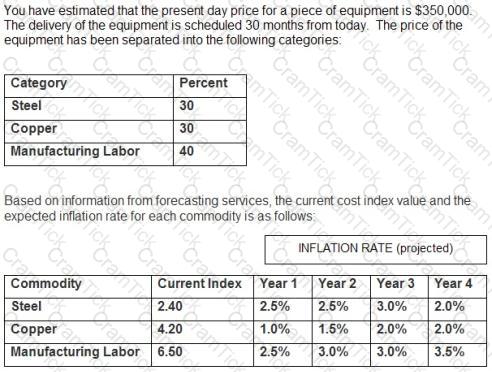

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

At the end of Year 3, steel prices will have increased by what percentage over today's price? (round to 1 decimal)

A project's data shows the budgeted cost of work scheduled as $27,000 and the actual cost of work performed as $25,000. If the baseline budget is $200,000 and the work o-ogress is 12%. what is the cost performance index (CPI)?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the 25 year after tax present worth of this project?

____________ is defined as covering work whose component activities are less defined and whose interrelationships are conditional.

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

The compound interest factor used to determine Present Value in year number 5 is:

You are reporting the following Earned Value Analysis information for the project:

EV= $1,500,000

AC=$1.000,000

PV= $2,000,000

What is the status of the project?

Cost performance index (CPI) is defined by AACE International as: (assume no change in budgeted quantities)

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

Which of the following is least likely to improve a large earthmoving contractor's productivity?

When using a fixed-price./lump-sum contract, which of the following; situations can a payment be made for the adjustment of fluctuations in the cost of of construction resources?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

When analyzing a precedence diagram schedule, the "backward pass"

Any combination of unique letters, numbers, or blanks, which describes and identifies any activity or task shown on the schedule, is:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

How much money should be set aside today to have $20,000 available eight (8) years from now if the interest rate is 6% compounded annually?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

According to Maslow's hierarchy of needs, which level should be satisfied first?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The main financial objective of many enterprises is:

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

At the end of 30 months, the final price for the piece of equipment will be:

After collecting the control information on a light rail project within an original budget of 200.000 work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor Is 60%.

What is the cost performance index (CPI)?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Taxes due at the end of year five (5) would be:

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

The taxable income in year number 5 is:

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

Which of the following methods a used for creating critical path schedules:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

If $100,000 is needed to purchase a piece of equipment 3 years from now, how much money needs to be invested today assuming a 10% rate of return (rounded to the nearest thousand)?

You have recently been appointed as the Cost Engineer to oversee process improvement projects for a Discrete Part Manufacturer. You have been asked to calculate the CPI on a project initiated to implement a Value Stream Mapping Initiative. The accountant is only able to provide you with BAC and EAC figures of $ 5000 and 57500 respectively. The CPI is:

unable to be calculated from the information given

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Is a rise in the price level of a good or service, or market basket of goods and/or services.

Which of the following is a common technique to approximate the standard deviation?

In the application of the benefit/cost method of analysis, what are the criteria for determining whether a proposed project is acceptable?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

The recognition of loss of value of a natural resource used in the production process is referred to as:

Deliberate low bidding is often referred to as buying the job. Which of the following would not be a reason for low bidding?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

All of the following are included in "income tax" calculations except:

_____________is defined as the budget for the cost (work) account times the percent complete for that account.

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

The project scheduler left the company and has left unfinished work. You have been hired as the new project scheduler and must update the existing schedule. What will be your first task?

AACE |