The total cost of a product is £200.

In order to achieve a profit margin of 20% of sales, the selling price would have to be:

Give your answer to 2 decimal places.

Budgets are produced:

(a) For planning purposes

(b) For control purposes

(c) To be published with the annual accounts

(d) To comply with international accounting standards

VL manufactures a single product. The management accountant has estimated that the margin of safety as a percentage of budgeted sales is 25%. The company's profit/volume ratio is 20%, variable costs are $8 per unit and budgeted sales for the year are 80,000 units.

The budgeted fixed costs for the year, to the nearest $000, are.

An increase in the variable cost per unit, will cause the point at which the line plotted on a profit/volume (PV) graph intersects the horizontal axis to:

A company’s management accountant wishes to calculate the present value of the cost of renting a delivery vehicle. There will be five annual rental payments of $5,000, the first of which is due immediately. The company’s discount rate is 12%.

Which TWO of the following are valid ways to calculate the present value of the rental payments? (Choose two.)

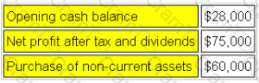

Refer to the exhibit.

An extract from the budget for GS is given below:

What is the company's budgeted cash holding at the end of the year?

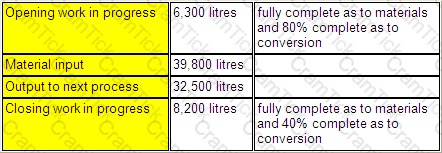

Refer to the exhibit.

A company operates a process costing system. The following data relates to Process X for the month of September.

Normal loss is 5% of input and all losses occur at the end of the process.

The number of equivalent units, using an average cost basis of valuation, was:

Materials:

In an integrated cost and financial accounting system, the accounting entries for PAYE deducted from gross wages would be:

Refer to the exhibit.

The wages analysis for the welding department of a manufacturing company is given below:

What is the direct labor cost for the welding department?

In an integrated cost and financial accounting system, the accounting entries for the payment of net wages to indirect production workers would be:

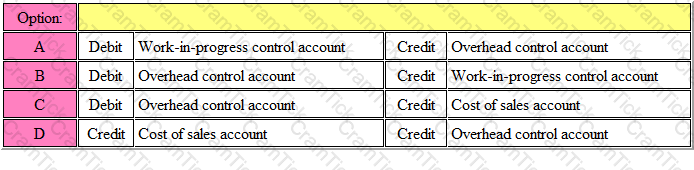

In an integrated accounting system, the accounting entries for over absorption of production overheads would be.

A product sells for £10 per unit and has an annual break-even volume of 50,000 units. The annual fixed costs are £100,000.

The variable cost per unit is:

Give your answer to 2 decimal places.

Zelts Ltd earns a contribution of 20% of the selling price for product 'Y'. The annual fixed costs are £200,000.

In order to earn an annual profit of £100,000 the sales revenue needs to be:

In an integrated cost and financial accounting system, the accounting entries for the cost of production units completed in the period would be:

Refer to the Exhibit.

A company operates a batch costing system.

Production overhead costs are absorbed into the cost of batches using a direct labour hour rate. Other overhead costs are absorbed at a rate of 20% of total production cost. The company adds a mark-up of 10% to total cost in order to derive its selling prices.

Budgeted production overheads for the period are $44,000 and the budgeted level of activity is 8,800 direct labour hours.

The following data are available for batch number 309:

The required selling price per unit (to two decimal places) is:

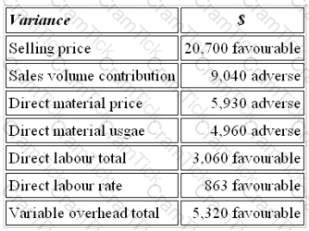

Refer to the exhibit.

The budgeted contribution for last month was $53,600. The variances reported were as follows:

The actual contribution for last month was:

A company’s cash budgetary plans show that there will be surplus cash for three months of the forthcoming year.

Which THREE of the following would be appropriate management actions in this situation?

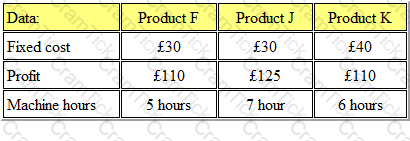

Refer to the Exhibit.

Zepher Ltd. manufactures three products, which require the same type of machine. The following fixed cost and profit per unit is available:

In a period in which machine hours are in short supply, which of the following options is the rank order of production?

Answer is:

Refer to the exhibit.

The following information is available for a production process:

The cost per unit of good output is:

Give your answer to 2 decimal places.

FL uses an absorption costing system. The overhead absorption rate for production overheads is $8.60 per direct labour hour.

Budgeted production overhead costs for the year were $473,000 and actual costs incurred were $468,000. 56,000 labour hours were used.

Which ONE of the following statements is correct?

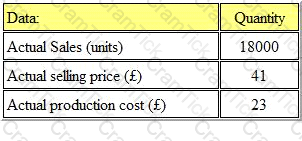

Refer to the exhibit.

Xey Ltd. has the following budgeted information for product T4 in July:

The actual results for July were as follows:

What is the total sales margin variance?

Which of the following are not advantages of Absorption costing? (Select ALL that apply.)

The following costs are incurred by a company which owns a five star hotel. Which THREE of the items would normally be classified as variable costs?

Refer to the Exhibit.

PJ Ltd has forecast that the relationship between total overheads and machine hours will be as follows:

If the budget is to be based on 4,000 machine hours, the variable overhead absorption rate will be:

*per machine hour.

Give your answer to 2 decimal places.

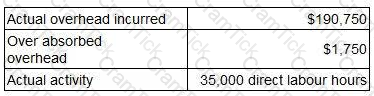

A company absorbs production overhead using a direct labour hour rate. Data for the latest period are as follows:

What is the overhead absorption rate per direct labour hour? Give your answer to one decimal place.

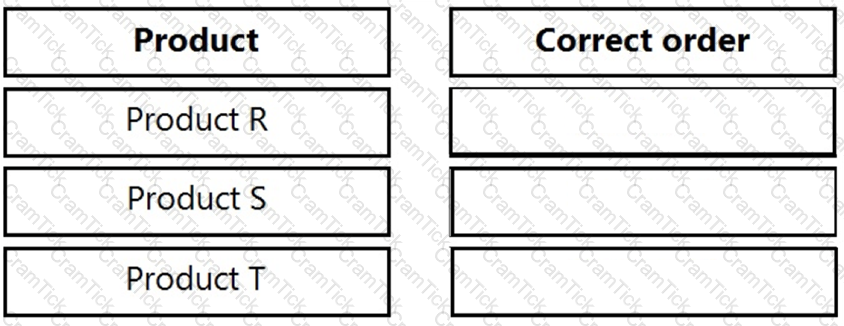

A company manufactures three products using the same direct labour which will be in short supply next month. No inventories are held. Data for the three products are as follows:

The fixed costs are all committed costs and cannot now be altered for the next month.

Place the labels against the correct product to indicate the order of priority for manufacture that will maximise the profit for the next month.

A company which manufactures and sells one product has fixed costs of $80,000 per period. The selling price per unit of $25 generates a contribution/sales ratio of 40%.

How many units would need to be sold in a period to earn a profit of $10,000?

Which of the following is NOT a characteristic of useful operational level information?

Which TWO of the following are characteristics of Management Accounts? (Choose two.)

Which THREE of the following are included in the Global Management Accounting Principles? (Choose three.)

Refer to the exhibit.

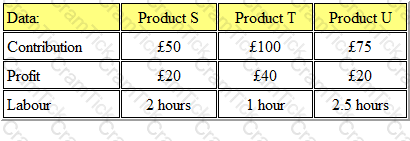

C Ltd manufactures three products, which require the same type of materials. The following contribution and profit per unit is available:

In a period in which labour hours are in short supply, which of the following options is the rank order of production?

Which of the following cannot be used to split costs into fixed and variable elements?

Which of the following would NOT be an appropriate performance measure for a profit centre manager?

A company operates an integrated standard cost accounting system. The standard price of raw material A is $20 per litre. At the start of period 1, the inventory of 500 litres of raw material A was valued at $20 per litre. During period 1, 100 litres of raw material A were purchased at an actual price of $21 per litre. During period 2, 550 litres of raw material A were issued to Job 789.

In respect of the above events, which TWO of the following statements are correct? (Choose two.)

The staffing policy for a supermarket is to have one cashier station open for every forecasted 20 customers per hour. Cashiers are hired by the hour as and when required, and do not perform any other duties.

The cost of the cashiers in relation to the number of customers would be classified as which type of cost?

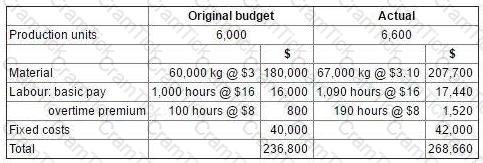

A company uses standard absorption costing. Budgeted and actual data for the latest period are as follows.

What was the production overhead absorption rate per unit?

The International Federation of Accountants (IFAC) stated that it was important that “accountants in business” should understand what the drivers of stakeholder value are. Which of the following statements is valid?

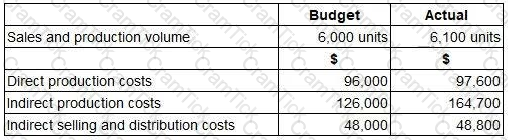

The budget and actual cost statements for the production department for the latest period were as follows.

Notes.

The 10% increase in production was required to meet unexpected additional sales demand.

The production manager is responsible for negotiating the price of materials with suppliers.

The normal working time is 900 hours per period. Any overtime worked above these 900 hours is paid at a premium of 50%.

In preparing the flexible budget for the latest period, which TWO of the following statements are correct? (Choose two.)

A company currently allows a discount of 10% to customers who pay at the time of purchase. If 20% of customers pay immediately, the extra sales needed in July to increase the cash receipts in that month by £9,000 are:

A company is considering investing $57,000 in a machine that will last for five years, after which time it will have no value. The machine will generate additional revenue of $190,000 each year. Annual running costs, including depreciation of $11,400 will amount to $168,400.

Assuming that all cash flows occur evenly, the payback period of the investment in the machine is closest to:

Refer to the exhibit.

In an integrated cost and financial accounting system, the accounting entries for factory overhead absorbed would be:

An increase in variable costs per unit, where selling price and fixed costs remain constant, will result in which of the following:

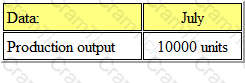

Refer to the exhibit.

RX Ltd expects to have limited machine time for July, which will result in the following production levels:

It is anticipated that there will be 1,500 units of opening inventory and the company wishes to hold a minimum of 500 units of closing inventory at the end of July.

How many units will be available for sale during July?

The records of a manufacturing company show the following relationship between total cost and output.

The budgeted output for Period 3 is 27,000 units. Assume that previous cost behaviour patterns will continue.

What is the total budgeted cost for Period 3?

Give your answer in the nearest whole number.

CIMA Certificate | BA2 Questions Answers | BA2 Test Prep | Fundamentals of Management Accounting Questions PDF | BA2 Online Exam | BA2 Practice Test | BA2 PDF | BA2 Test Questions | BA2 Study Material | BA2 Exam Preparation | BA2 Valid Dumps | BA2 Real Questions | CIMA Certificate BA2 Exam Questions